U.S. Stock Market Outlook: June 2023

Growth nearing fair value, time to take profits and reallocate to value.

June Stock Market Outlook Takeaways:

- U.S. stock market unable to break out of trading range, looking for economic rebound

- Growth stocks surge higher, good time to take profits as we now see better value elsewhere

- Technology sector becoming overvalued as stocks surge on excitement surrounding artificial intelligence

Trying to Break Through the Ceiling

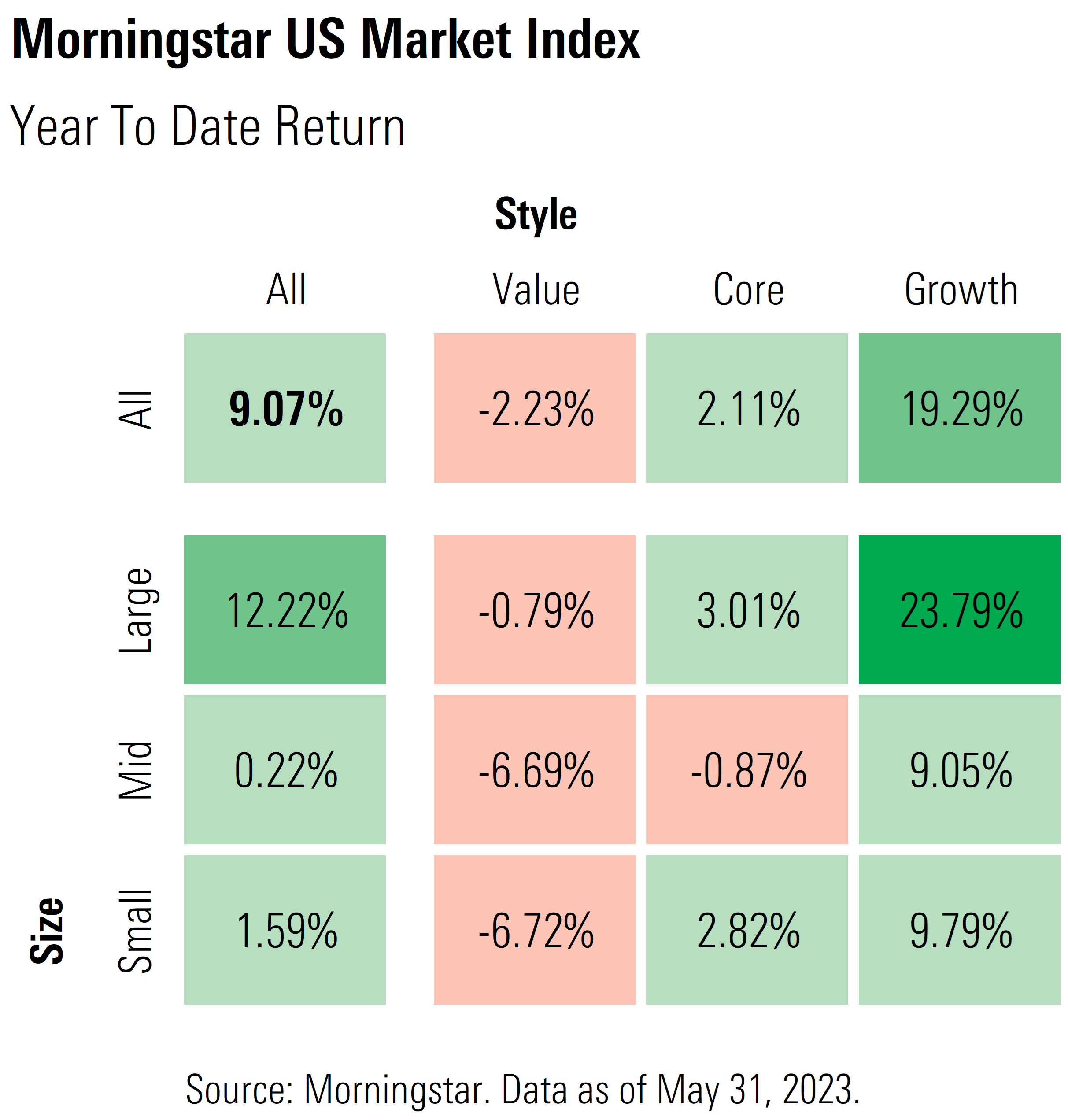

The Morningstar US Market Index rose 0.45% in May and has risen a total of 9.07% for the year to date through May 31. Considering that we expect the U.S. economy will be relatively stagnant over the remainder of this year, we suspect the market will be looking for a rebound in leading economic indicators later this year to begin the next leg up toward where we calculate intrinsic value.

The rally thus far this year has been heavily concentrated in the growth category, which has soared 19.29%, whereas core stocks have lagged, only rising 2.11%, and value has lost ground, at negative 2.23%.

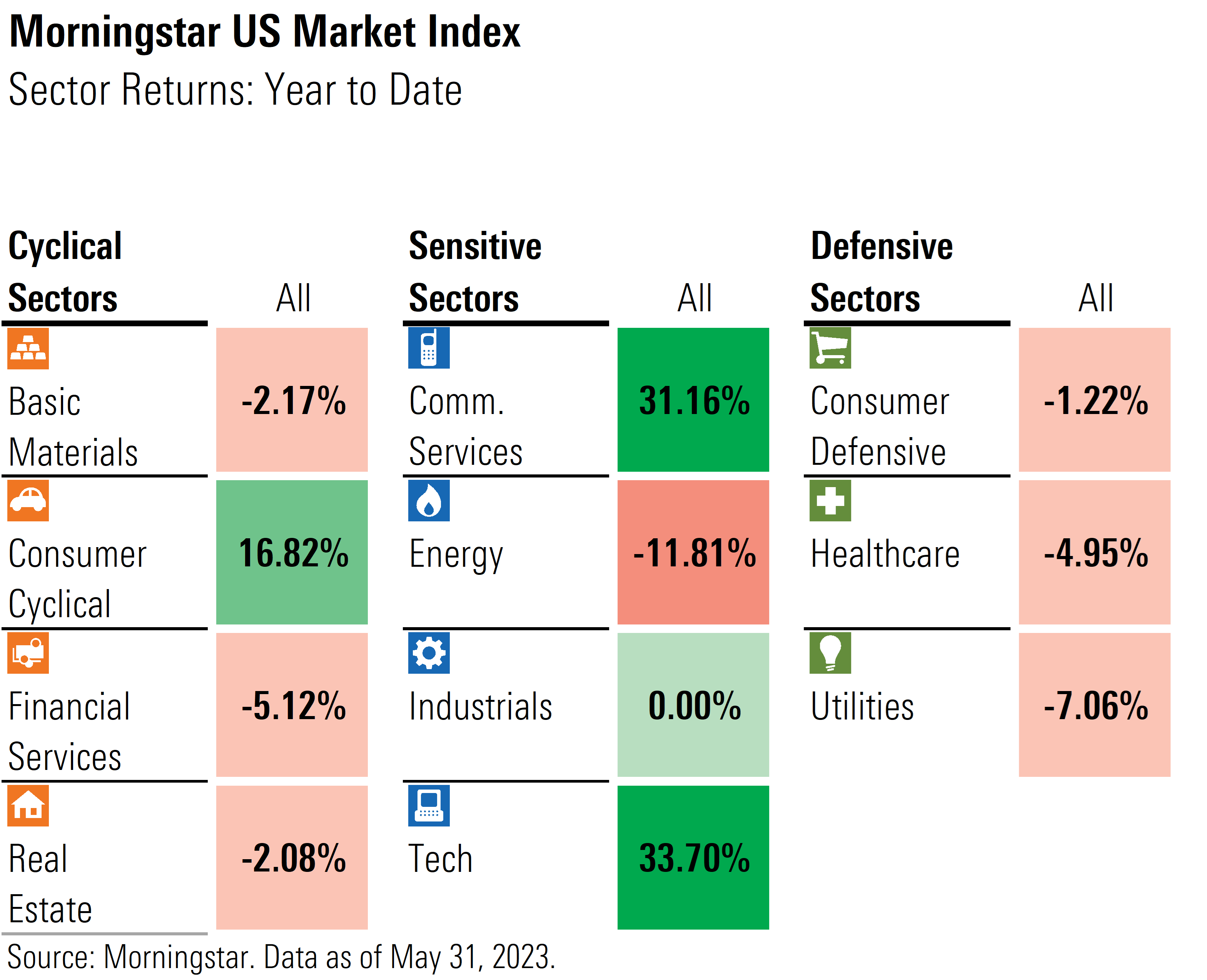

Even more specifically, within the growth category, the technology and communications sectors drove the preponderance of the increase. In May, technology rose 10.32% and communications rose 6.00%. For the year to date, technology is up 33.70% and communications is close behind at 31.16%. Elsewhere, the consumer cyclical sector is the only other to post a positive return. In our 2023 Stock Market Outlook, we noted that these were the most and third-most undervalued sectors coming into the year.

To the downside, energy (which was the most overvalued sector coming into the year) fell the greatest amount during May, dropping 9.55%, and has posted a negative 11.81% decline thus far this year. The utility sector (second-most overvalued sector coming into the year) fell 5.64% in May and has dropped 7.06% for the year to date. Even defensive sectors such as consumer defensive failed to protect investors; it dropped 5.90% in May and is now down 1.22% this year. The consumer defensive sector was trading at a 4% premium over our intrinsic value at the beginning of the year.

Latest U.S. Stock Market Valuation and Trends

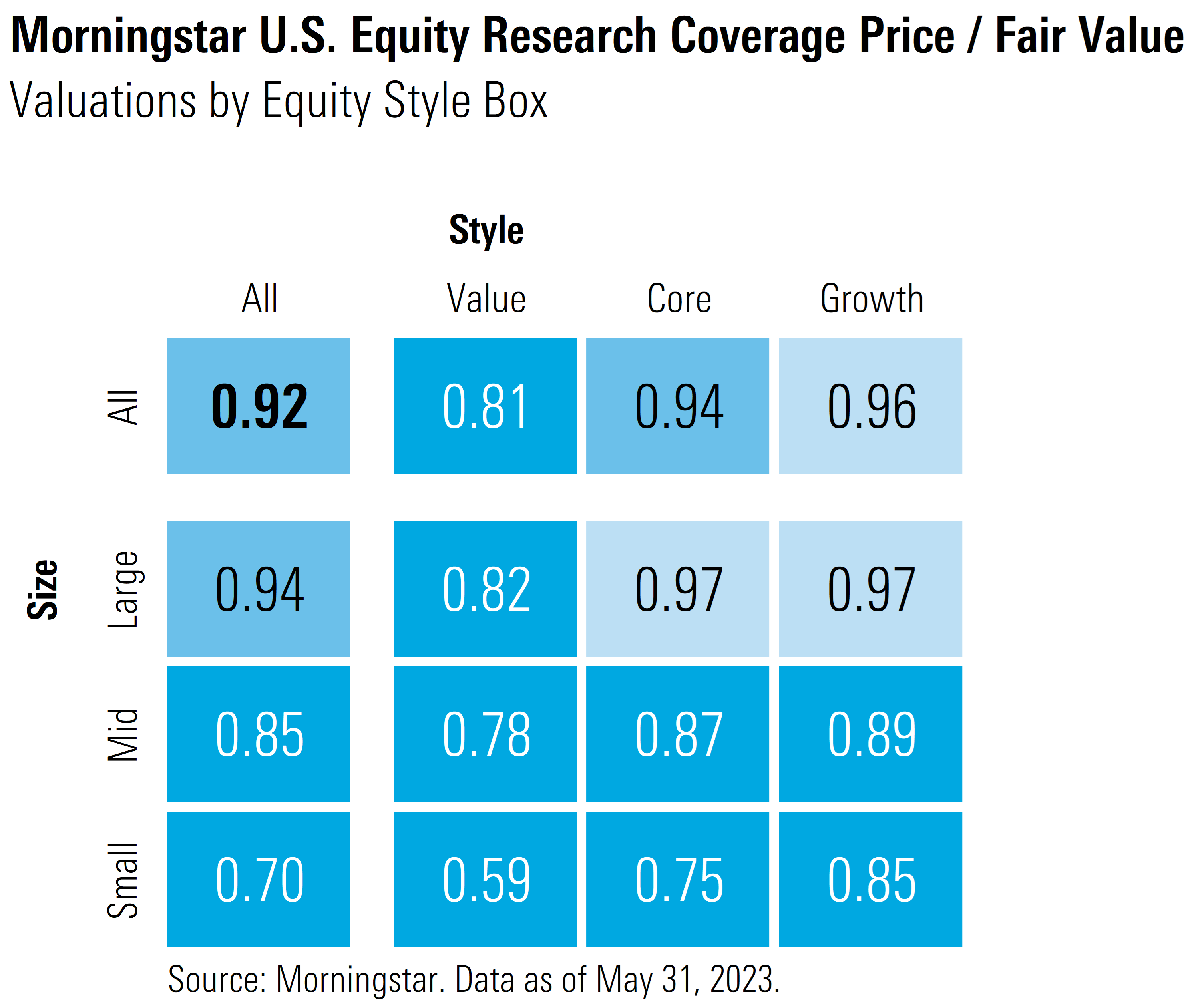

The broad U.S. market is 8% undervalued as of May 31, according to a composite of the over 700 stocks we cover that trade on U.S. exchanges.

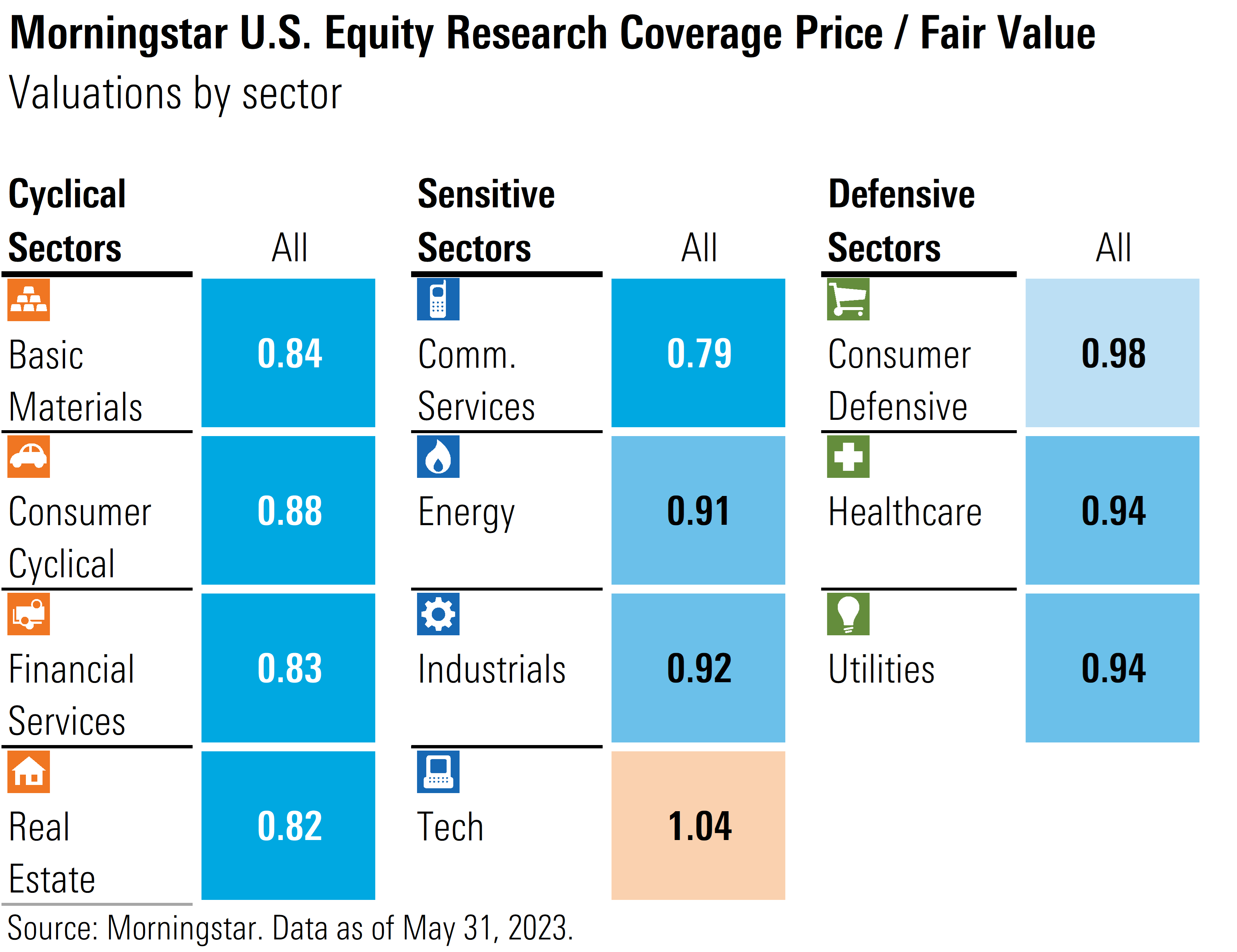

Sector Valuations

Although the communications sector is the second-highest returning sector this year, it remains the most undervalued. Within communications, Alphabet GOOGL has risen 39.15% this year but remains a 4-star-rated stock as it trades at a 20% discount to our intrinsic valuation. Meta Platforms META has risen 119.98% this year and has now moved into 3-star range after having started the year with a 5-star rating.

Across the remaining sectors, we see the best values across the cyclical sectors. Although we expect the economy to be relatively stagnant over the remainder of this year, these were the worst performing sectors in 2022, and we think the market had pushed prices down too far as compared with our long-term intrinsic valuations.

Real estate and financial services are the next two most undervalued sectors. Real estate has been pulled down by negative sentiment across the commercial real estate segment, especially as valuations for urban office space ratchet down because of lower postpandemic occupancy rates. Although office space valuations may have further to fall, many other areas such as shopping malls are enjoying an increase in foot traffic as consumer behavior reverts back to prepandemic habits. Financial services, especially regional banks, have been under pressure following the failures of Silicon Valley Bank and Signature Bank. In our view, while the regional banking business model is under stress, it is not permanently broken. For investors willing to undertake a higher degree of volatility, we see a significant number of opportunities across the sector. We highlighted numerous opportunities among regional banks last month in our May 2023 Market Outlook.

After its strong outperformance this year, the technology sector is now the most overvalued sector, trading at a 4% premium over our intrinsic valuations, whereas at the beginning of the year it traded at a 19% discount. While select individual opportunities remain, from a sector perspective, we now think this is a good time to take profits and move toward an underweight position.

Energy is the worst performing sector for the year to date. Energy started the year as the most overvalued, trading at a 12% premium over our intrinsic valuation, but following its pullback, it has now moved to a 9% discount to our fair value. Considering the sector discount is almost the same as the market discount, investors may consider moving to a market-weight position from underweight.

Year-to-Date Returns Highly Concentrated

While the market has experienced a relatively strong rally this year, the gains have been highly concentrated in a handful of companies. Of those that have performed best, many are companies that the market considers to be positively leveraged to the evolution of the burgeoning artificial intelligence industry.

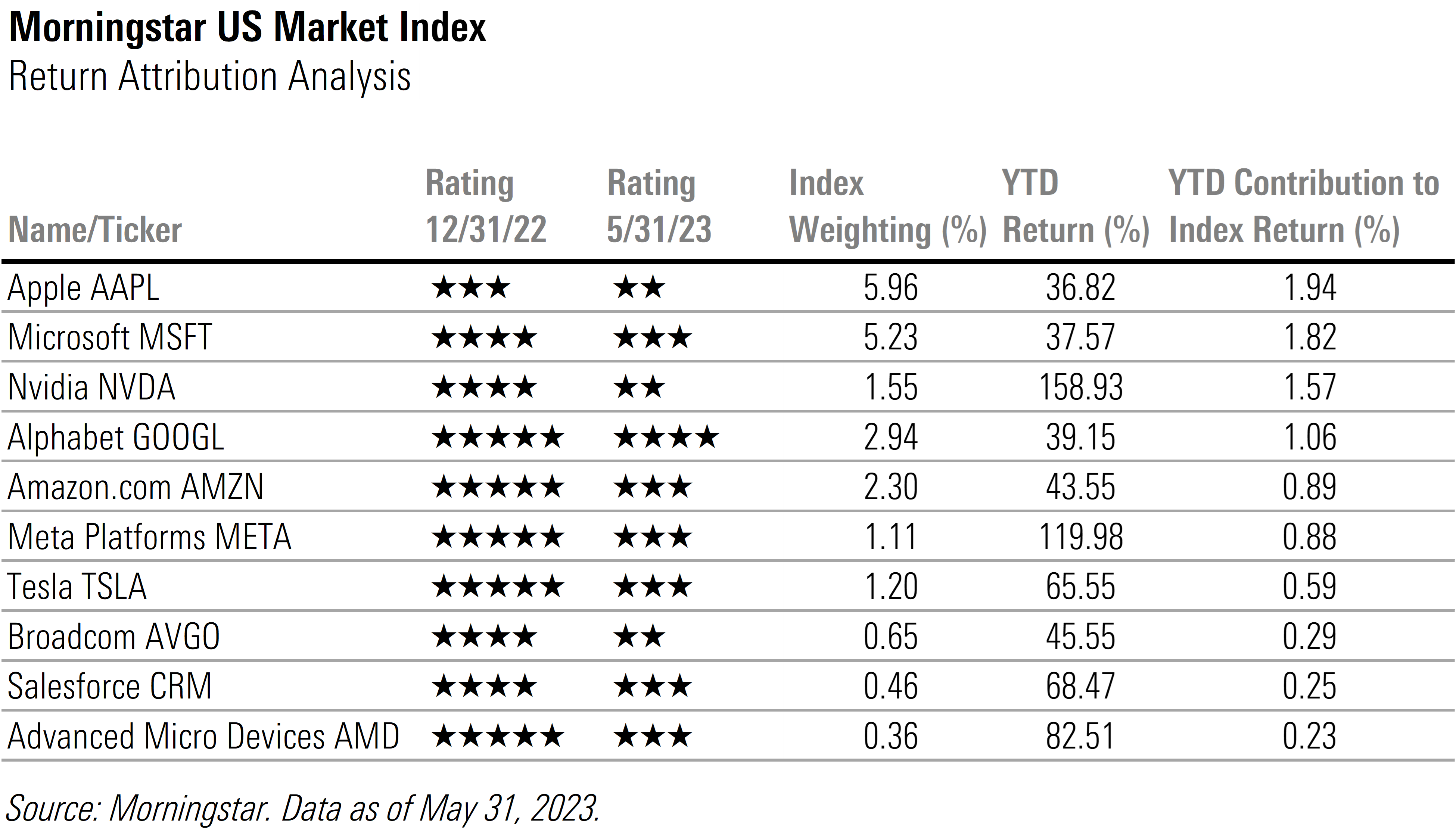

When conducting an attribution analysis of returns of the Morningstar US Market Index (those companies whose stocks accounted for the greatest amount of return in the index), the combined returns of the top five companies have contributed 7.27% of the 9.07% return for the year to date. In fact, the top 10 companies have contributed 9.50%, slightly greater than the overall index return. Thus far this year, 48% of the 1,497 stocks in the index have posted positive returns, whereas 52% have realized losses.

Of these 10 stocks, nine were undervalued and rated either 4 or 5 stars at the beginning of the year. Following the rally, only one remains 4-star rated and three are now overvalued, having fallen into 2-star territory. Eight of the 10 stocks are in the large-growth category and two are in the large-core category.

By sector, six are technology, two are communications, and two are consumer cyclical. Six of the stocks (Advanced Micro Devices AMD, Amazon.com AMZN, Broadcom AVGO, Google, Microsoft MSFT, Nvidia NVDA) are considered to be beneficiaries of the burgeoning adoption of artificial intelligence.

Looking Forward

While the stock market remains undervalued according to our valuations, we continue to expect a rough road ahead over the next few quarters. We project that the combination of tight monetary policy and declining credit availability will take its toll on the economy over the course of the year.

We forecast economic growth will stagnate in the second quarter, contract slightly in the third, and only begin a sluggish recovery in the fourth. A weak economy will pressure earnings growth and likely lead to a negative sentiment in the markets. We expect that the markets will be looking for an upswing in leading economic indicators in order to begin the next move higher toward our long-term, intrinsic valuations. In our view, investors should look past this potential short-term volatility and, where their risk tolerance allows, use pullbacks to move from market weight back into overweight positions.

Weekly Livestream to Provide You With What You Will Need to Know for the Week Ahead

Interested in staying up to date with our research and learning about new investment ideas? Join Susan Dziubinski and I on Monday Morning Markets With Morningstar at 8 a.m. CT / 9 a.m. ET via our livestream as we discuss:

- what investors should be watching the week ahead,

- new financial research from Morningstar you shouldn’t miss, and

- weekly stock picks & pans.

Over the past two weeks, Susan and I have been keeping investors up to date with earnings and highlighting those stocks that we think are undervalued and worth your attention. Our most recent livestreams include:

5 Undervalued Stocks for a Sideways Market, where we discussed our take on the debt ceiling and the commercial real estate market and reviewed Altria MO, CME Group CME, Crown Castle CCI, Duke Energy DUK, and Kellogg K.

5 Cheap Value Stocks to Buy, where we discussed our market valuations, including our view that the value category is the most undervalued today with stocks such as BorgWarner BWA, Carnival Cruise Lines CCL, Citigroup C, Macerich MAC, and Medtronic MDT all trading at depressed levels.

2 Big Tech Stocks to Buy, where we interviewed Ali Moghrabi, Morningstar’s senior equity analyst who covers Alphabet and Meta Platforms, to provide his investment thesis and valuation on these two stocks.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UYSRGR6ZLJFWXDECADZPSR7BJU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MLKHO4HEDJETLPBTREPIAMGQBE.png)