Does the Apple Savings Account Live Up to the Hype?

How it works and what it yields.

Apple’s AAPL new high-yield savings account has been a roaring success since it launched on April 17, 2023. The offering reportedly scooped up nearly $1 billion in assets during its first four days of life.

Apple has a built-in audience of millions of iPhone aficionados who were likely enticed by the 4.15% annual percentage yield currently offered on Apple Savings. Despite repeated hikes in the federal-funds rate since early 2022—totaling nearly 500 basis points—traditional banks have been slow to raise rates on deposit savings accounts. Based on information from the FDIC website, savings-account yields averaged just 0.40% as of May 15, 2023.

Apple Savings’ tight integration with the Apple ecosystem makes it an easy next step for consumers who already use Apple Pay for making purchases, Apple Wallet for storing credit-card numbers, and Apple Card for earning cash-back rewards. But investors looking to maximize yield on their savings can find better options elsewhere.

How Apple Savings Works

Although Apple’s entree into consumer savings could be viewed as a first step toward becoming a full-scale robo-advisor—and the company’s extensive reach with potential investors might make that a logical end game—Apple’s website repeatedly states, “Apple is not a financial institution.” Indeed, Apple Savings is offered by Goldman Sachs GS, which does have a bank charter but has failed to make significant inroads with its own forays into mass-market products such as consumer loans and direct-to-consumer savings. Like other savings accounts, Apple Savings accounts are guaranteed up to the FDIC insurance limit of $250,000 (per depositor and per bank).

To use Apple Savings, savers must first set up an Apple Card, which is a credit card also issued by Goldman Sachs. Apple Card has no annual fee and offers cash-back rewards on certain transactions: 3% on Apple products and services (including iPhones, iPads, laptops, movies, music, and games), 2% on purchases made through the Apple Pay app, and 1% on other transactions. Cardholders can also earn up to 3% cash back on purchases made through certain retailers, including Ace Hardware, Duane Reade, Exxon Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. Unlike other cash-back reward programs, which often accumulate monthly, Apple’s cash rewards accumulate daily; consumers can opt to automatically transfer this Daily Cash to the savings account.

Apple Savings account owners can also transfer in outside balances by setting up a link to an external bank account. However, the total balance for Apple Savings may not exceed $250,000. If owners need to access funds in Apple Savings, they must first transfer them to Apple Cash (subject to a $10,000 per-transfer limit or $20,000 per rolling seven-day period) or to a linked external account. (Apple Cash is a digital payment service that can be used for spending or money transfers.)

How Does the APY on Apple Savings Stack Up?

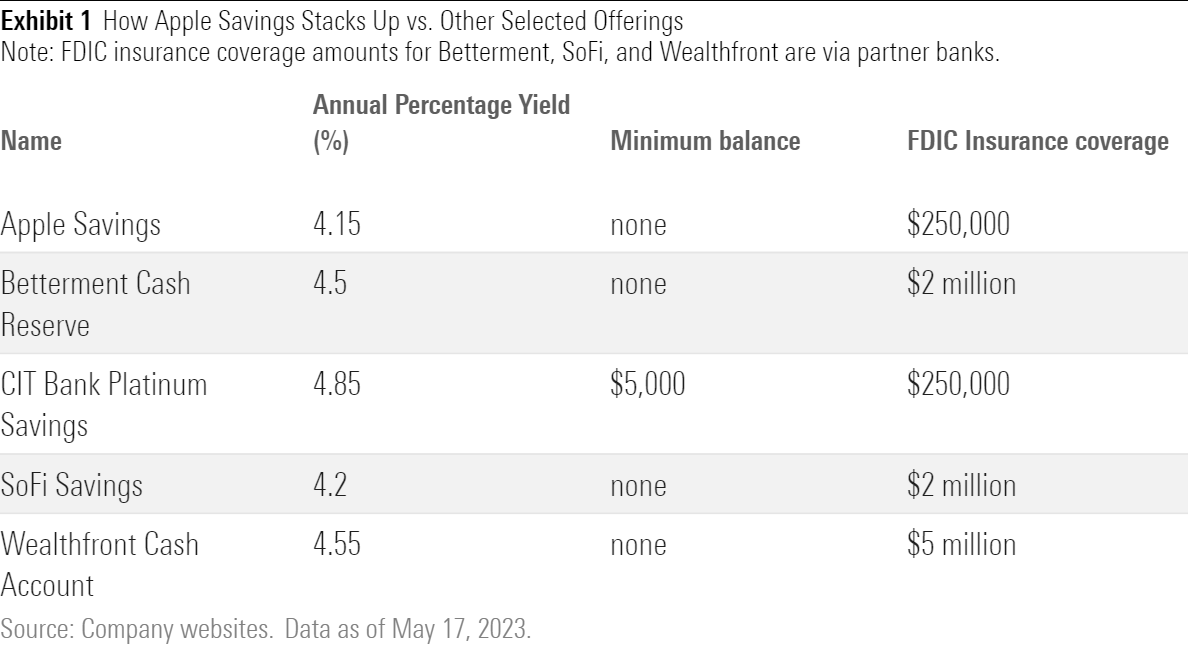

As I mentioned earlier, Apple Savings’ 4.15% annual percentage yield is well above the national average for all savings accounts. But it’s not that difficult to find offerings with more attractive yields, as shown in the table below.

I didn’t do an exhaustive search, but CIT Bank Platinum Savings currently offers a 4.85% APY, albeit with a $5,000 minimum balance requirement. SoFi, Betterment, and Wealthfront offer APYs ranging from 4.20% to 4.55%; they also boast more generous FDIC coverage amounts (up to $5 million for Wealthfront) by working with a network of partner banks.

Money market funds, while not covered by FDIC guarantees, can also be a good option for short-term savings. The table below shows some of the offerings available from major brokerage platforms.

It’s worth noting that all of these yields—including the APY for Apple Savings—are subject to change with the prevailing interest-rate environment. If and when interest rates eventually reverse course, yields for both money market funds and high-yield savings accounts would decline, as well.

Other Limitations for Apple Savings

Apple’s new savings offering has a few other minor drawbacks. It can only be accessed via Apple Wallet, and account owners must use an iPhone with the latest version of iOS (currently 16.4.1). These strictures mean it’s effectively off-limits for Android users or more casual iPhone users who may not be as diligent about keeping up with operating-system updates.

In addition, Apple Savings can’t be set up as a joint account shared with another person. (The Apple Card can be set up with a co-owner or Family Sharing Group, but any proceeds from cash-back purchases would need be deposited to a Savings account owned by one person.) This makes it less attractive for many couples who share their finances.

Conclusion

Ultimately, Apple Savings is probably most compelling for iOS aficionados who are already using Apple Pay for many of their daily purchases, particularly those who are big spenders or already sharing the Apple Card with multiple family members. The main positive is the ability to seamlessly transfer cash-back balances to an FDIC-insured savings account with a decent yield. For other investors, though, the yield probably isn’t high enough to justify getting locked into Apple’s ecosystem.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2OLS3MLLBMTIYCEYJOKJ725MWM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)