U.S. Fund Flows: Widespread Outflows Defined March

Investors fled stock funds for safer choices.

U.S. mutual funds and exchange-traded funds followed up a modest aggregate outflow in February with a more substantial one in March as they shed $25 billion. Just two of the past 12 months have seen aggregate net inflows. Seven of the 10 U.S. Morningstar Category groups suffered outflows in March.

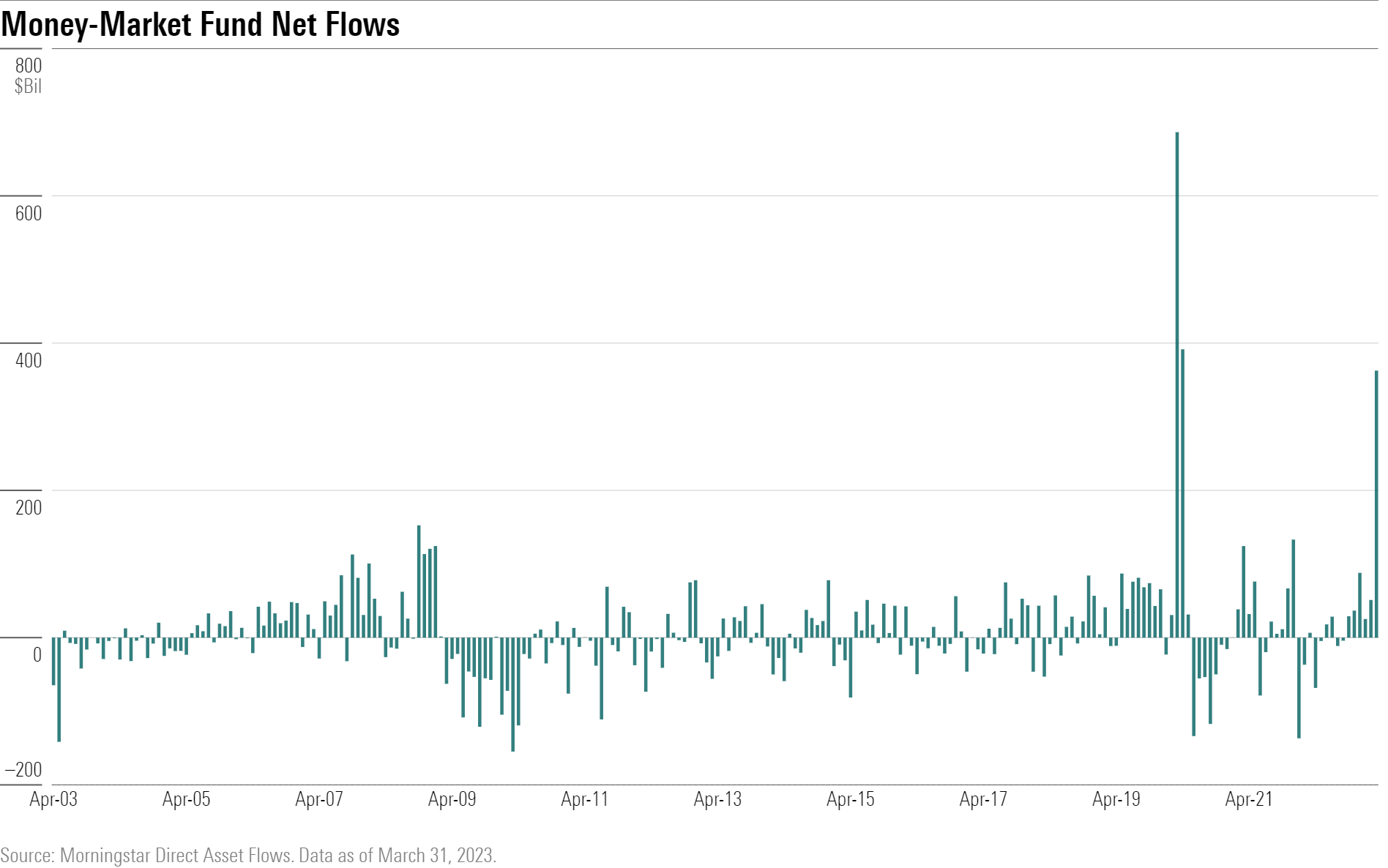

Money Market Funds See Surge of Inflows Amid Bank Turmoil

Money market funds took in $363 billion in March, their third-largest haul in Morningstar data beginning in 1993 and their fourth-largest intake on an organic-growth basis. Fears of contagion from bank failures earlier in the month likely sent depositors fleeing to store their money in alternative cashlike vehicles.

Investors Buy the Dip in Regional Bank ETFs

Plummeting regional bank stock prices attracted a fresh batch of buy-the-dip investors in March. As the S&P Regional Banks Select Industry Index dropped more than 28%, investors poured $1.2 billion into the ETF that tracks it, SPDR S&P Regional Banking ETF KRE. Not all regional bank ETFs saw inflows, however, preventing the cohort from a record-setting month.

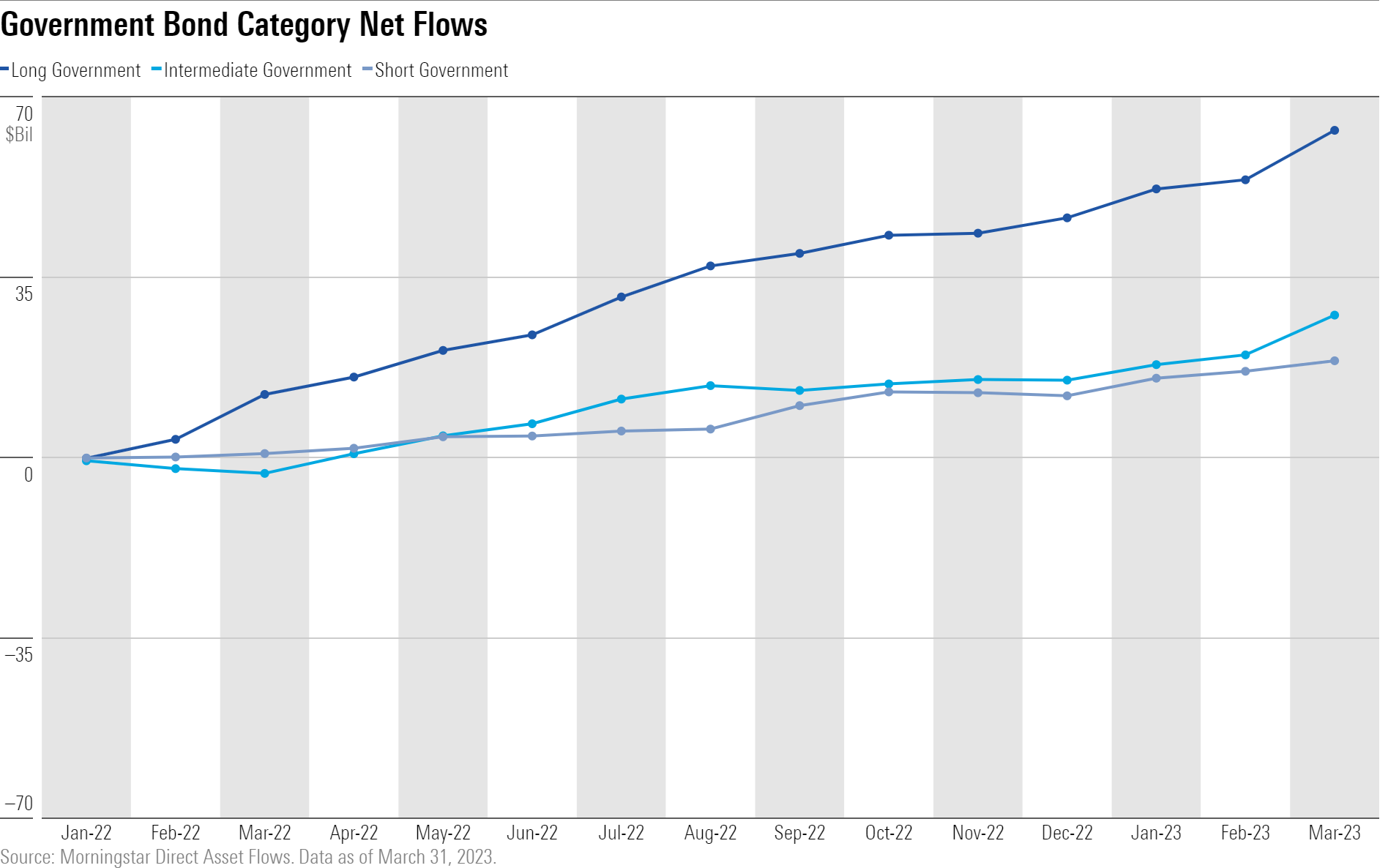

Treasury Funds Stay on Top

Government-bond funds represent about 9% of the taxable-bond cohort by assets but collected more than half the money that flowed into it in the first quarter. Long government led all categories with nearly $17 billion in first quarter flows, good for a 16% organic growth rate. That carried last year’s momentum into 2023 as investors continued to seek safety.

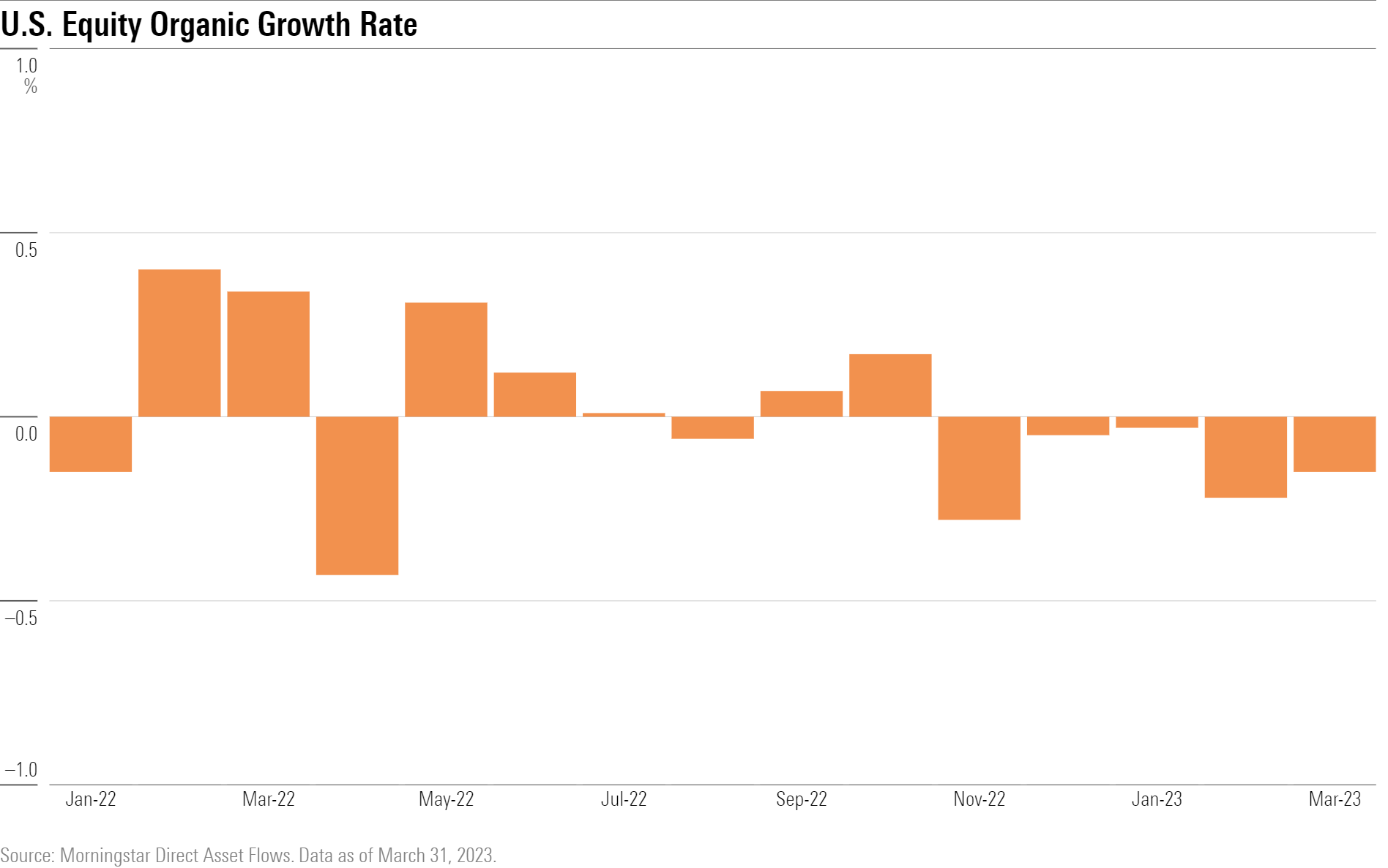

U.S. Equity Fund Flows Remain Lackluster

With March’s $16.5 billion outflow, U.S. equity funds have now lost assets in five consecutive months. Eight out of the group’s nine categories suffered outflows in March, with only large-blend funds enjoying inflows (mostly into passive offerings, as usual). Active U.S. equity funds shed $20.5 billion, while passive funds collected about $4 billion.

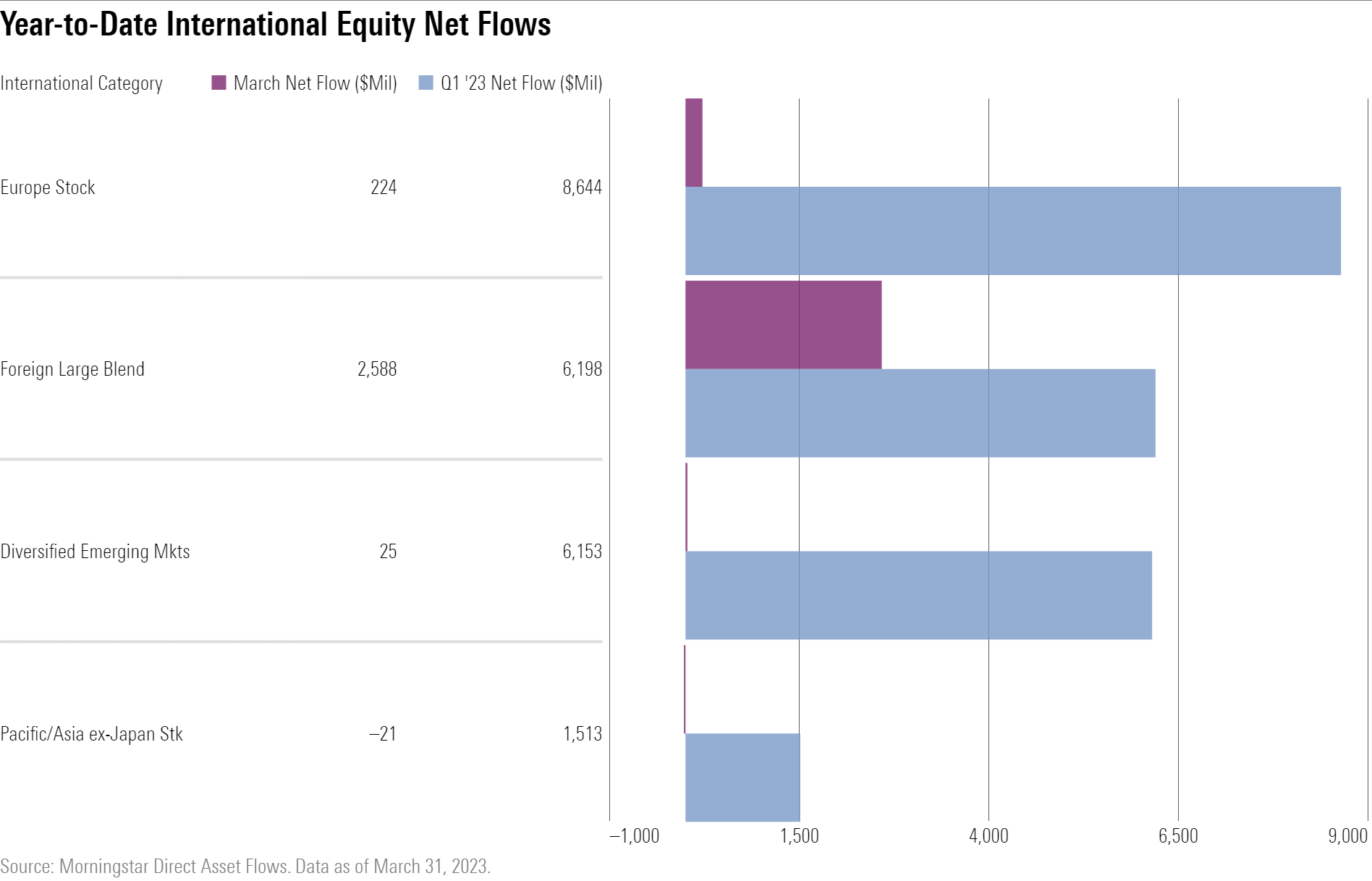

March Tests International-Equity Funds’ Resurgence

After a strong start to 2023 that saw the category group collect nearly $17 billion, international-equity funds saw about $4 billion leave in March. Europe-stock funds were the cohort’s hottest category in January and February but took in a paltry $224 million in March. Still, international-equity funds collected $12.6 billion during the first quarter.

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for March 2023. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5PEUA7XEBNFN5NFCFQ73HT5XIM.png)