Best International Companies to Own: 2023 Edition

These companies from various corners of the globe are well positioned for the future.

Investors from almost every part of the world exhibit a certain amount of home bias: the tendency to prefer domestic equities to international ones. This makes sense. Investors are likely more familiar with these brands and consequently are more comfortable putting their money toward them.

But in today’s investing world “adding international exposure is one of the first steps toward a diversified portfolio,” according to Morningstar portfolio strategist Amy Arnott. If, for example, the U.S. dollar weakens, exposure to European or Asian equities can soften the impact.

With that in mind, how can stock investors tackle international investing?

First, it’s important to remember that at Morningstar, we don’t view investing through the lens of daily price movements or hot tips. We see owning a single stock as similar to owning a small part of the company or the underlying business itself.

Consider the amount of effort we devote to researching and comparing options before buying a car. It tends to be a lot, and it tends to work out well for our needs, exceeding expectations and providing a reliable form of transportation. This is the same approach we take to buying a stock.

One of the best ways to identify high-quality companies is by checking out the Morningstar Economic Moat Rating, which assesses a company’s competitive advantage. The term “economic moat” was coined by Warren Buffett, who said, “The key to investing is ... determining the competitive advantage of any given company and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors.”

We used the moat rating as a starting point to compile a list of the best companies you can own. As the best companies in our coverage universe, they have wide economic moat ratings, the strength of their competitive advantages is either steady or increasing, they have predictable cash flows, and they allocate their capital effectively. (You can learn more about this methodology here.)

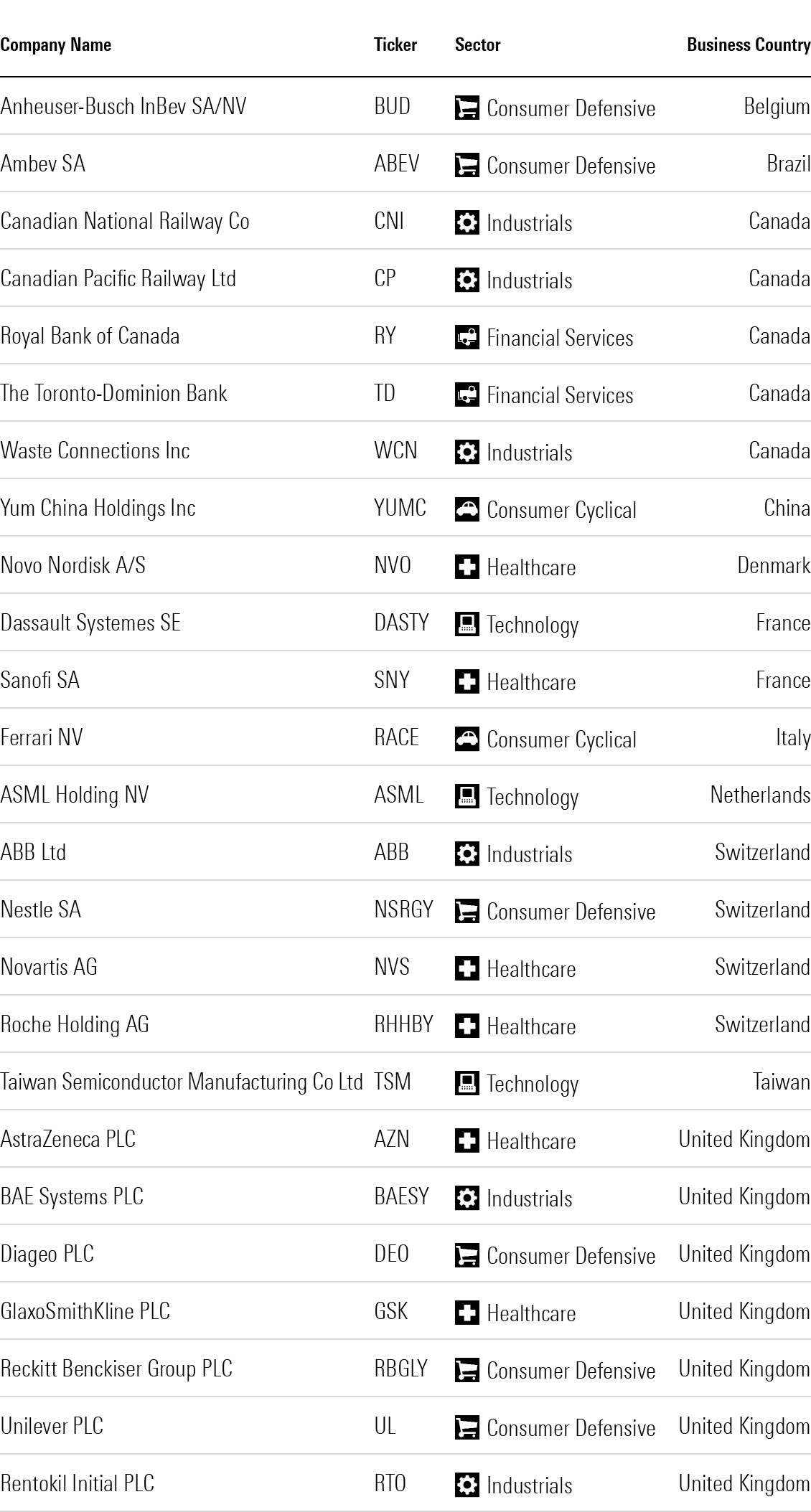

Here are the 25 companies based outside of the United States, but available to U.S. investors, that made the cut.

Best International Companies to Own: 2023 Edition

Consumer defensive, healthcare, and industrials are the most represented sectors on this list, with six companies each. Technology is close behind with three companies. Consumer cyclical and financial services round out the list with two a piece.

This is a notable difference from the U.S.-based names on our list of best companies, where a majority of the firms reside in industrials, with technology in second place, healthcare in third, and the consumer defensive and financial-services sectors tied for fourth.

A note of caution: This list is not a call to action for you to buy all these companies immediately. Rather, it is a list of stocks you should keep an eye on and look for attractive entry points. Even the greatest company can be a bad investment if you overpay, and many firms on this list are currently overvalued.

That said, we note two stocks on the list that earned Morningstar Ratings of 5 stars as of Apr. 11, 2023, meaning they are undervalued according to Morningstar‘s fair value estimates.

They are Switzerland-based Roche Holding RHHBY, a global pharmaceutical and diagnostic company, and Taiwan Semiconductor Manufacturing Company TSM, which is the world’s most valuable semiconductor company. Here’s what our analysts have to say about these two undervalued names from the list.

Roche Holding

“We think Roche’s drug portfolio and industry-leading diagnostics conspire to create maintainable competitive advantages. As the market leader in both biotech and diagnostics, this Swiss healthcare giant is in a unique position to guide global healthcare into a safer, more personalized, and more cost-effective endeavor. Strong information sharing continues between Genentech and Roche researchers, boosting research and development productivity and personalized medicine offerings that take advantage of Roche’s diagnostic expertise.

“Roche’s biologics focus and innovative pipeline are key to the firm’s ability to maintain its wide moat and continue to achieve growth as current blockbusters face competition. Blockbuster cancer biologics Avastin, Rituxan, and Herceptin are seeing strong headwinds from biosimilars. However, Roche’s biologics focus (more than 80% of pharmaceutical sales) provides some buffer against the traditional intense declines from small-molecule generic competition. In addition, with the launch of Perjeta in 2012 and Kadcyla in 2013, Roche has expanded its breast cancer drugs, and Phesgo, a subcutaneous coformulation of Herceptin and Perjeta, is launching in the United States. Gazyva, approved in CLL and NHL and in testing in lupus, will also extend the longevity of the Rituxan franchise. Avastin’s lung cancer sales are vulnerable to biosimilars and competition from new therapies Opdivo and Keytruda, but Roche’s own immuno-oncology drug Tecentriq launched in 2016, and we see peak sales potential above $10 billion. Roche is also expanding outside of oncology with MS drug Ocrevus ($9 billion peak sales) and hemophilia drug Hemlibra ($6 billion peak sales).

“Roche’s diagnostics business is also strong. With a 20% share of the global in vitro diagnostics market, Roche holds the number-one rank in this industry over competitors Siemens SIEGY, Abbott ABT, and Ortho. Pricing pressure has been intense in the diabetes-care market, but new instruments and immunoassays have buoyed the core professional diagnostics segment.”

—Karen Andersen, sector strategist

Taiwan Semiconductor Manufacturing Company

“Taiwan Semiconductor Manufacturing is the world’s largest dedicated contract chip manufacturer, or foundry. It makes integrated circuits for customers based on their proprietary integrated circuit designs. The firm has long benefited from semiconductor firms around the globe transitioning from integrated device manufacturers to fabless designers. TSMC, like all foundries, assumes the costs and capital expenditures of running factories amid a highly cyclical market for its customers. Such cyclicality stems from the fact that foundries tend to add excessive capacity during times of burgeoning demand, which can result in underutilization during downturns that hampers profitability.

“The rise of fabless semiconductor firms has been maintaining the growth of foundries, which has in turn encouraged increased competition. However, most of these newer competitors are confined to low-end manufacturing owing to prohibitive costs and engineering know-how associated with the leading-edge technology. To prolong the excess returns enabled by leading-edge process technology, or nodes, TSMC initially focuses on logic products, mostly used on central processing units and mobile chips, then focuses on more cost-conscious applications. This strategy has been successful, illustrated by the fact that the firm’s one of the two foundries still possessing leading-edge nodes when dozens of peers lagged.

“We note two long-term growth factors for TSMC. First, the consolidation of semiconductor firms is expected to create demand for integrated systems made with the most advanced nodes. Second, organic growth of artificial intelligence, the Internet of Things, and high-performance computing applications may last for decades. Artificial intelligence and high-performance computing play a central role in quickly processing human and machine inputs to solve complex problems like autonomous driving and language processing. Cheaper semiconductors have made integrating sensors, controllers, and motors to improve home, office, and factory efficiency possible.”

—Phelix Lee, equity analyst

Editor’s Note: This article is based on the 2023 edition of Morningstar’s Best Companies to Own. Find the full list of companies and read about our selection methodology.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MG6XOCYGF5BO7MG5YRNBISB3SA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TXAOQ3NTDNAVLGMP3O4BVUVFTA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RH6K4NMACRHO3DQIPX57HVLLAU.png)