The Anti-ESG Fad Might Be Over Before It Got Going

Fund flows peaked in third-quarter 2022. One fund filed to liquidate.

Correction: This article and its exhibits have been updated to include Strive Emerging Markets Ex-China ETF.

In the United States, criticism of sustainable investing has become incredibly politicized over the past year. To understand the timeline and their magnitude, in a recent study we took a look at the funds—Morningstar counts 27—that have picked up the anti-ESG banner. Although there’s been a lot of talk about anti-ESG funds, it’s not clear that they have staying power.

What’s an Anti-ESG Fund?

Generally, such funds take the opposite tack from sustainable investing and its sibling, environmental, social, and governance investing. We took a broad approach to defining the group of funds included in this report, but some of the fund companies included may not see themselves as opponents of ESG investing, and some anti-ESG advocates were likely excluded.

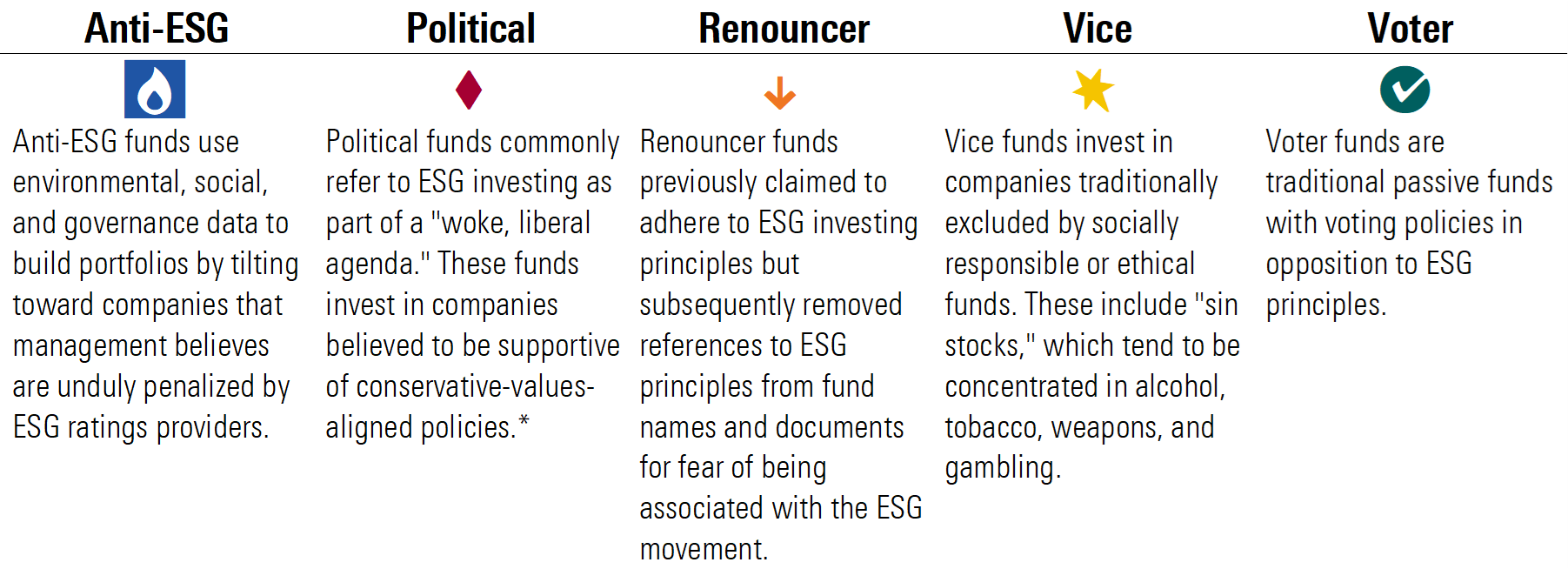

We grouped these funds into five mutually exclusive categories, primarily by referencing prospectus language, which mirrors the process we follow to establish Morningstar’s sustainable funds universe. For the occasional borderline case, we consulted proxy-voting policies and marketing materials. The categories are Anti-ESG, Political, Renouncer, Vice, and Voter.

Anti-ESG Categories

Anti-ESG investments come in all shapes and sizes. As such, the lines between these five anti-ESG categories are blurred, and in many cases, it is unclear whether a fund qualifies as anti-ESG, a plain-vanilla index fund, a niche thematic offering, or something else entirely.

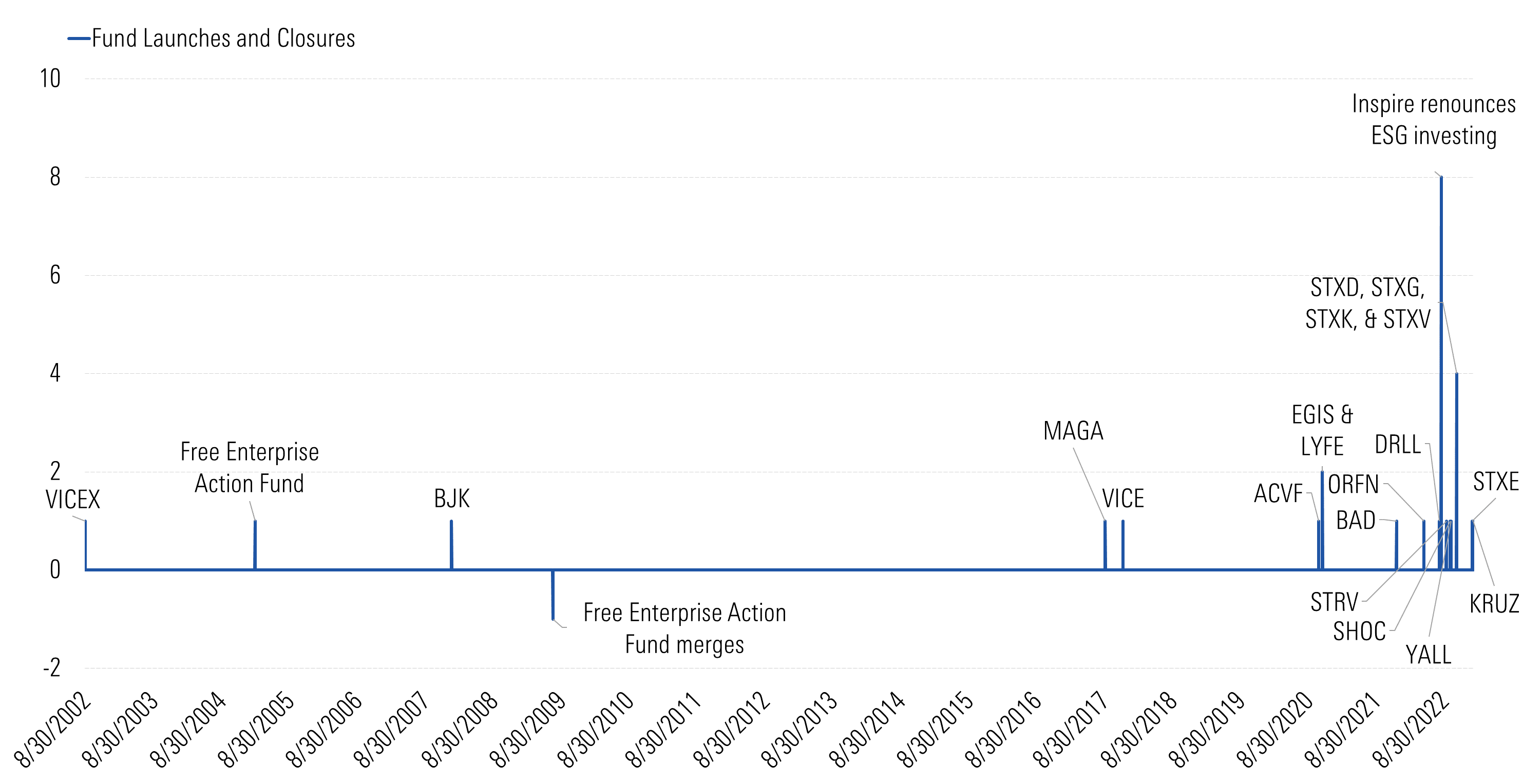

Most Anti-ESG Funds Have a Short Track Record, but the Sentiment Is Older

With the exception of two vice funds—VanEck Gaming ETF BJK and USA Mutuals Vice Fund VICEX—anti-ESG funds have short track records. The chart below shows that the vast majority of these funds have cropped up within the past two years.

Timeline of Anti-ESG Product Development

However, anti-ESG sentiment is not a new phenomenon in the United States.

In her recent article, climate writer Emily Atkin traced the origins of the modern-day anti-ESG movement to 2004, when tobacco lobbyist Steve Milloy and Philip Morris alum Tom Borelli formed the Free Enterprise Education Institute, a nonprofit focused on discrediting corporate social responsibility, or CSR, initiatives. The group managed a website called “CSR Watch: Your eye on the anti-business movement” and started a fund—the Free Enterprise Action Fund—to invest in companies that management viewed as economically disadvantaged as a result of social activism. In the fund’s prospectus, the firm provided examples of what it termed “harmful social activism”: “Energy companies that have forgone investment in power plants based on social and environmental activism rather than on the projected profitability of building such facilities” and “Companies that have made certain benefits available and other concessions to their employees based on activism rather than on sound management principles.”

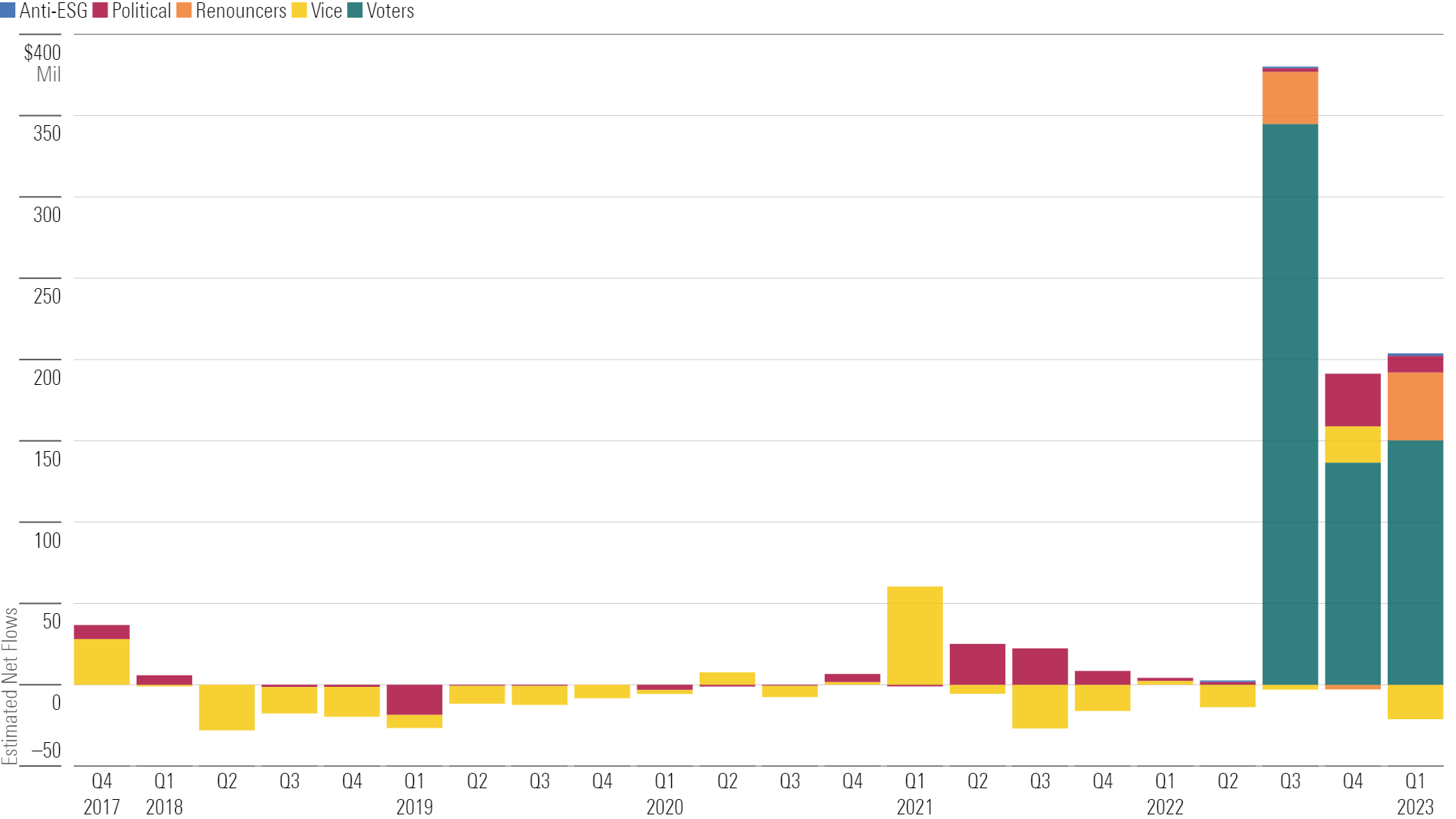

Anti-ESG Fund Flows Peaked in 2022′s Third Quarter—but Quickly Lost Steam

Boosted by product development, flows into anti-ESG funds peaked at $377 million during the third quarter of 2022. More than 80% of that was collected by Strive’s first fund—Strive U.S. Energy ETF DRLL—which attracted nearly $100 million in its first week. Strive looked poised to continue this momentum when it launched seven more funds over the following three months, but what started as a downpour slowed to a drizzle.

Strive’s second fund—Strive 500 ETF STRV—picked up $33 million in its first month on the market, and the following six funds attracted less than $5 million on average in each month since launch. In January 2023, Strive Emerging Markets Ex-China ETF STXE launched and picked up $103 million at inception, but monthly flows have averaged $5 million since (through May). Moreover, in February 2023, Strive’s cofounder Vivek Ramaswamy declared his candidacy for the U.S. presidency, building on an anti-ESG policy platform.

The following exhibit shows net flows into the five categories of anti-ESG funds beginning with the fourth quarter of 2017 (the first time that investors had more than two Vice funds to choose from).

Quarterly Net Flows Into Anti-ESG Funds

The lone fund in our Anti-ESG category has struggled so far to gain traction. Constrained Capital ESG Orphans ETF ORFN launched in May 2022 and picked up $870,000 on average in each quarter since. On June 2, 2023, the fund filed to liquidate.

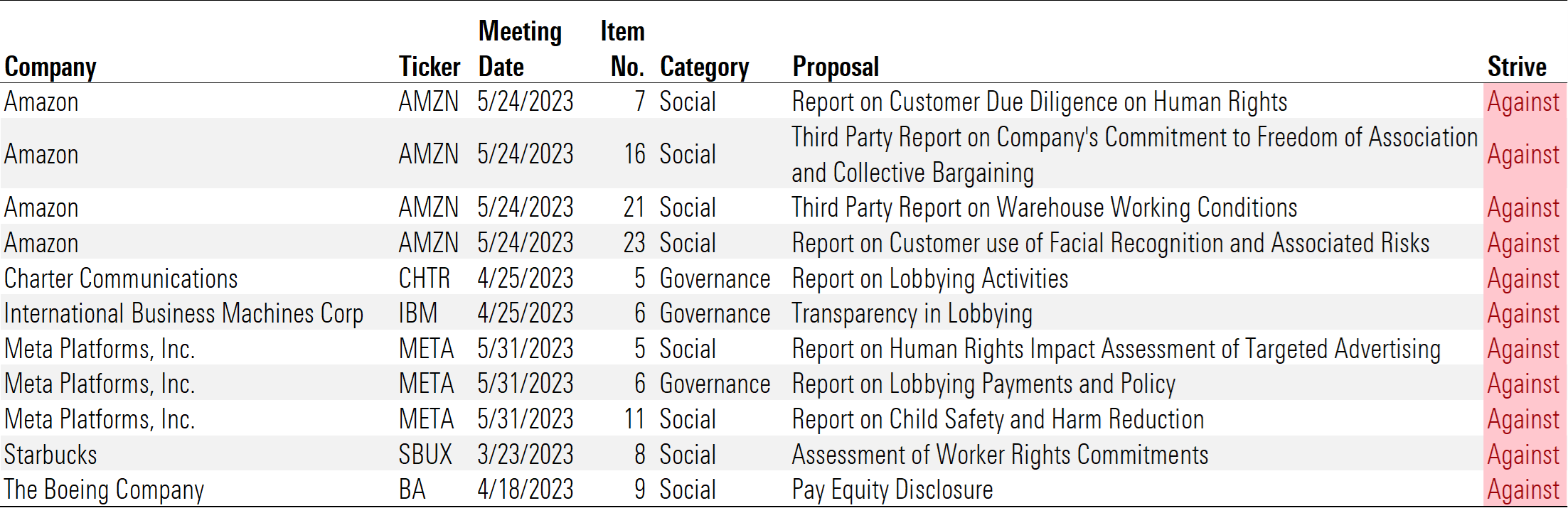

Anti-ESG Funds Vote Down Environmental and Social Shareholder Proposals

Strive’s ETF lineup comprises the Voters category of anti-ESG funds. These funds track traditional broad market indexes and promise to generally oppose environmentally or socially motivated shareholder proposals. The annual proxy season concludes at the end of June, and Strive’s funds only launched in August 2022, so we don’t yet have a full season’s worth of voting records to evaluate. However, early indicators show that Strive’s policy is playing out as promised.

So far, Strive voted against all 11 of the key ESG shareholder resolutions that we have identified at S&P 100 companies so far in 2023. These resolutions related to issues such as working conditions, pay equity, lobbying activities, and the freedom to unionize.

Strive’s Voting Decisions on 11 Key ESG Shareholder Resolutions

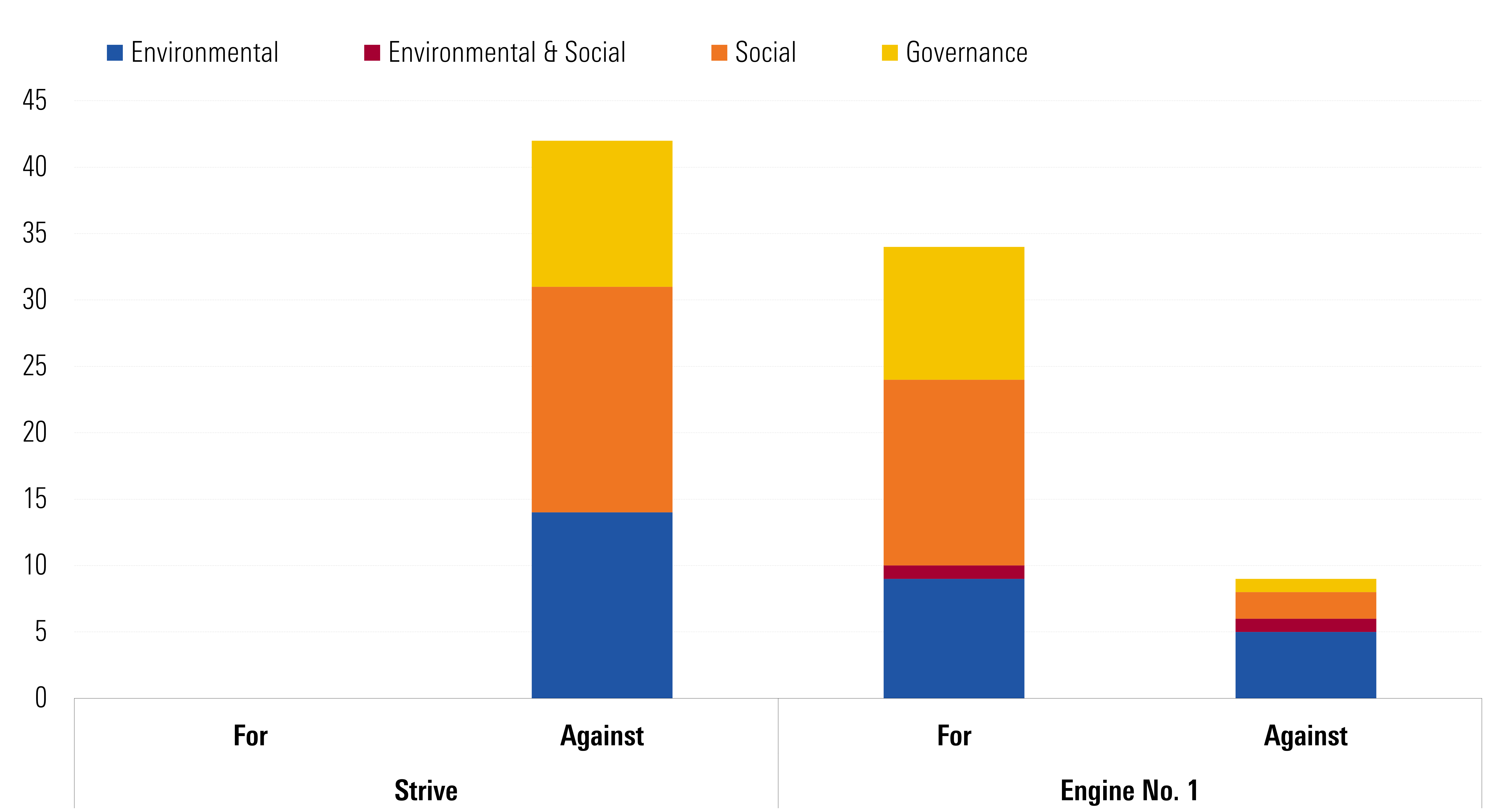

Intentionally or not, Strive’s approach seems to serve as an anti-ESG foil to that of Engine No. 1, which attracted significant attention when it successfully campaigned to replace three members of Exxon’s board with directors more focused on climate change in 2021. Both firms aim to vote for resolutions that help managers more effectively run their companies, but they take different stances on how helpful environmental and social measures are to this effort.

We evaluated a list of 44 ESG-related resolutions put forward at large U.S. companies in 2023, and Strive and Engine No. 1 opposed one another in 80% of cases. Engine No. 1 voted in support of all 11 key ESG resolutions mentioned above, as well as some resolutions that received lower levels of overall support (including one that requested additional reporting on gender/racial pay gaps at Amazon.com AMZN).

Comparison of 44 ESG Proxy-Voting Decisions

Strive and Engine No. 1 made the same decision on nine of the 44 resolutions. These resolutions were put forward at Chevron CVX, Exxon Mobil XOM, and Meta Platforms META, and topics ranged from setting scope 3 greenhouse gas emissions reductions targets to reporting on community impact from plant closures or energy transitions. In each of these cases, the company board recommended a vote against the proposal, and Strive and Engine No. 1 agreed. We can’t say for certain why Strive and Engine No. 1 made the same decision on these proposals. It may be that the resolutions themselves were too prescriptive to receive significant shareholder support; those statistics are not yet available.

One thing is clear: Anti-ESG investing is not a monolith.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/L256SFNCVFD73CRB6NRPCGC2SU.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HIQXA25F5IM6Z7ZHNZ7EKMWAOI.png)