What Is Bitcoin’s Energy Consumption Worth?

The cost of production model has the potential to establish a reasonable benchmark for bitcoin.

Lately, we’ve been evaluating different approaches to modeling bitcoin based on defining characteristics of the asset. In the first two weeks, we estimated demand for bitcoin based on its potential as a store of value and as a network for exchange. Last week, we examined the impact of bitcoin’s limited supply on its price. To round out our analysis we’ll look at how to value the energy costs of mining a bitcoin.

At one point it was possible to mine bitcoin with a single desktop PC and a borrowed internet connection, but as bitcoin has become more popular, miners now have to cough up significant capital for advanced computer systems. They also have to pay high ongoing electricity bills to keep their machines running continuously.

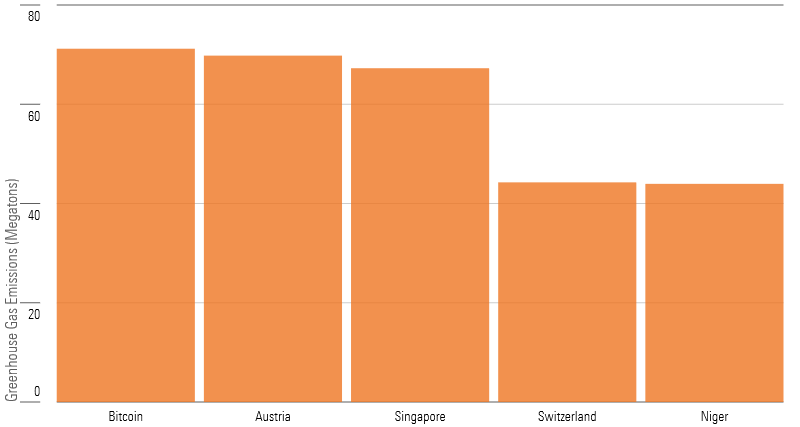

This conspicuous energy consumption has nabbed headlines that compare bitcoin’s electricity consumption with that of entire countries; bitcoin does not stack up favorably.

Bitcoin Burns as Much Greenhouse Gas as Entire Countries

The Cost of Production valuation model argues that bitcoin must be worth at least the electricity it takes to mint a coin. Otherwise, if miners couldn’t break even, in the long run they’d cease to operate, and that electricity would get reallocated to more productive uses.

Out of all the valuation theories we’ve explored, the cost of production model stands out as the most pragmatic. If a breakeven operating price for bitcoin exists, it’s logical that it would encompass the ongoing energy expenses required to maintain the ledger.

However, despite its conceptual merits, I’m not embracing this model just yet.

The key limitation plaguing the cost of production model is that its independent and dependent variables are locked in a feedback loop. Production costs influence prices, but crucially, prices also influence production costs.

What is Bitcoin Worth?

Valuing bitcoin under the total addressable market approach.

What Is Bitcoin’s Network Worth?

Network effects are more complicated to model for bitcoin than for other assets.

What is Bitcoin's Scarcity Worth?

A look at how the timing and magnitude of releases of bitcoin affect its price.

Miners enter the market when prices are high and exit when prices are low. The presence of more miners increases competition, making mining more difficult and raising production costs. As a result, valuations produced by a cost of production model experience tailwinds during boom times and headwinds during downturns.

With two such closely related factors, correlation will never be able to prove causality. Even so, it can serve as a helpful gut check on the market in cases when prices dip below the cost to produce.

Producing a Cost of Production

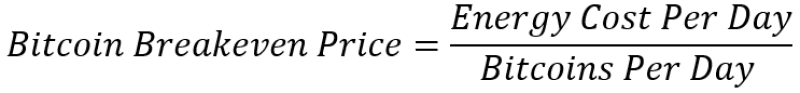

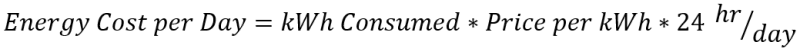

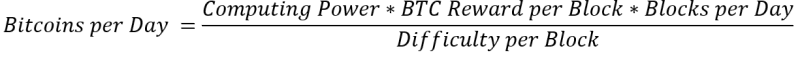

Cost of production is a marginal model, meaning it focuses on the trade-offs presented only by minting the next unit of bitcoin. This marginal cost to produce can be calculated by dividing the cost of operating for a day by the number of bitcoins awarded per day, yielding the electricity cost for the next token mined. It represents the breakeven price at which bitcoin would need to trade for the average miner to continue mining for one additional token award.

The cost of energy, a key component of the model, is not possible to measure in practice. Each miner has their own unique cost of energy that will determine whether or not it’s prudent for them to continue operating. For the purposes of this model, we estimate it by multiplying the price per kilowatt-hour by 24 hours in a day and the energy consumed by a single mining rig.

Two crucial assumptions hide beneath the surface of this formula. First, in order to calculate the number of kilowatt-hours consumed, we have to estimate the computing capacity of an average miner, when that naturally changes over time as some miners consolidate and new operations pop up. We also assume a constant price per kilowatt-hour across the industry, when in practice each miner is going to have drastically different energy costs depending on their local market.

It’s simpler to find the number of bitcoins awarded per day. All we have to do is multiply the number of bitcoins created per block by the number of blocks produced daily, adjust for our average miner’s computing power, and divide that figure by the difficulty of bitcoin’s algorithm. This calculation provides the number of tokens a standard mining operation can earn per day.

The perk of the cost of production model is that it relies on inputs that are totally independent of the cryptocurrency ecosystem. As a result, it’s capable of generating a wider range of outcomes than simply “to the moon.” For example, as computers become more efficient with time, the cost of production model may actually forecast a lower breakeven price for bitcoin. Relative to the other models we have looked at, the framework behind the cost of production model looks downright balanced.

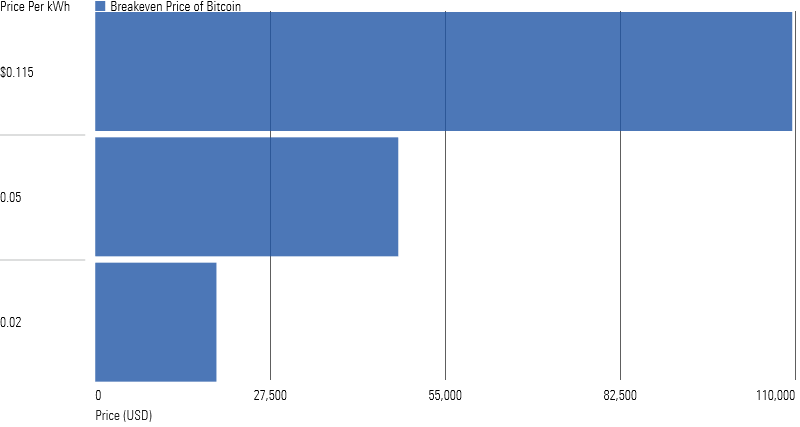

Further supporting that view, the model is also capable of producing a valuation that’s somewhat upbeat even during a terrible cryptocurrency tailspin. In our version of the cost of production model, we produce a breakeven price of $47,600—a significantly higher price than where bitcoin is trading currently, which is around $28,800 as of May 2023.

Valuation Methodologies for Bitcoin Produce a Wide Range of Outcomes

The logic of the cost of production model suggests that if the marginal cost to produce another unit of bitcoin is higher than the current price, production will slow until equilibrium is restored via a higher price or more-efficient supplier base. But for cryptocurrency specifically, a breakeven price higher than the current price does not necessarily signal that bitcoin is cheap or that sloppy miners will exit the market en masse.

Our cost of production model relies on simplifying assumptions regarding things like computing rig size and historical electricity prices that do not reflect the operating model of every mining operation.

Breakeven Price Varies Depending on Cost of Energy Inputs

Our forecast merely applies to a hypothetical miner who we define as average; what’s average today may not be average six months or a year from now. This fact exposes a complicated reality about the cost of production model. Today it’s only capable of producing short-term estimates, based on the decision to mine the next incremental coin.

The cost of production model stands out as the most pragmatic...However, despite its conceptual merits, I’m not embracing this model just yet.

Madeline Hume

In spite of the hurdles I’ve laid out, the cost of production model should not be dismissed. Unlike the other models we’ve studied, it has the potential to establish a reasonable benchmark for bitcoin, reducing volatility and enhancing investor experiences in the process.

Better measurement of key variables is the first step. Time series data on actual energy prices paid by miners, the efficiency of the computers they use, and the size of an average mining operation, would provide valuable insights that enhance the model’s reliability.

A note on the disclaimer below: Most digital assets, including the cryptocurrencies mentioned in this article, are not currently classified as shares of registered securities by the SEC and therefore do not fall under Morningstar’s editorial policies. However, in the interest of full disclosure, the author of this article does own digital assets mentioned in this article.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)