MEDIA KIT

Morningstar Magazine Readex Research

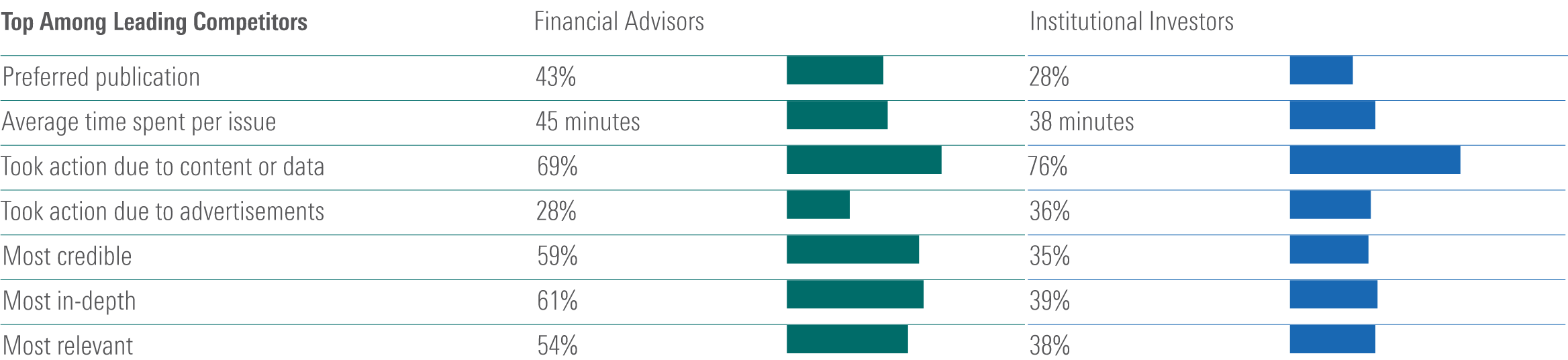

The results of our readership survey, carried out by Readex Research, found that Morningstar magazine was seen to have the most credible, in-depth, and relevant investment analysis.

Morningstar Magazine Readex Survey Results

Source: Readex Survey.

Morningstar Magazine Demographics

Type of Investment Professional

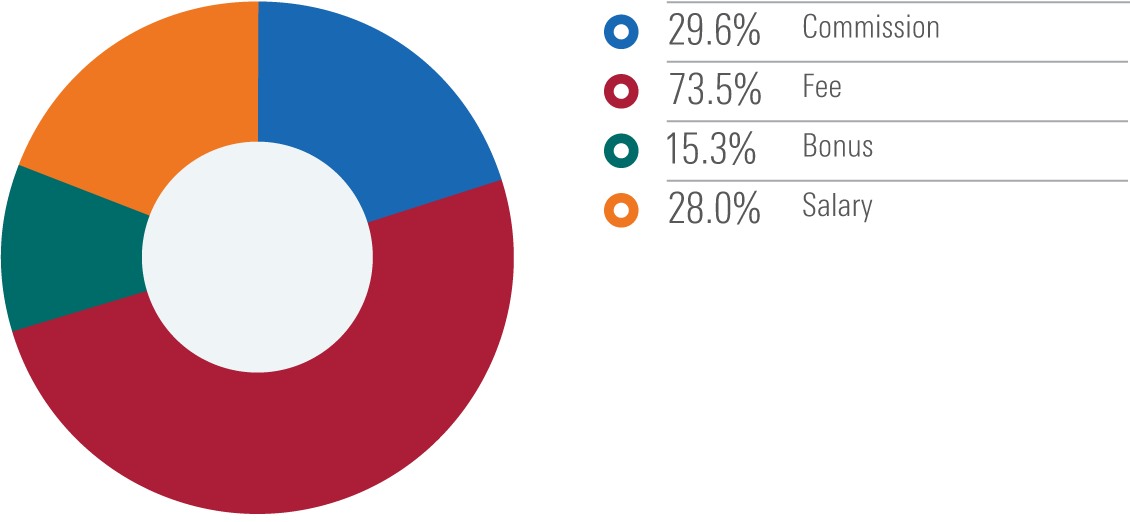

Compensation Method

Assets Under Management (%)

Perspectives From Readex Advisor Survey

Morningstar Magazine is one of the most comprehensive and valuable magazines I receive. It is packed with a wealth of information—nearly every article is worth reading. I spend more time reading Morningstar Magazine than I do any other publication.

Morningstar Magazine is a very valued resource. I read it cover to cover and often use its recommendations.

Source: 2021 Morningstar Advisor Survey—Advisors who read Morningstar Magazine.

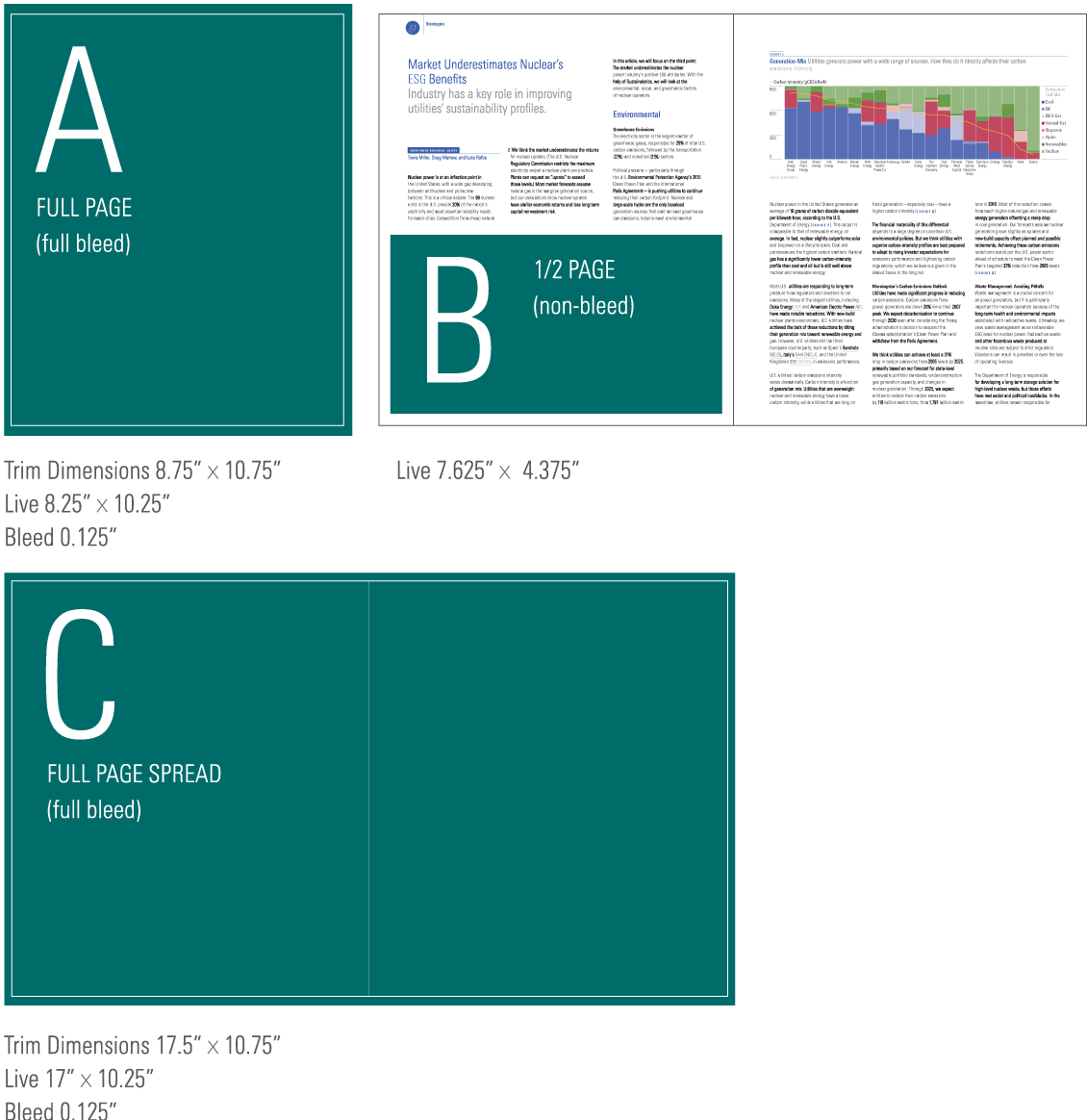

Morningstar Magazine Print Ad Units

About the Magazine

Morningstar magazine is published four times a year. 59% of subscribers have been in the financial services industry for 21+ years, hold multiple designations, recommend a broad spectrum of products, and manage an average of $410 million in clients assets.

Our readers are an engaged group of highly intelligent decision-makers, actively looking to our publication for investment ideas and insights. Our award-winning editorial content, design, and investment analysis put Morningstar magazine at the top of its class.

Premium Placements*

- Back Cover

- Inside Front Cover

- Inside Back Cover

- Inside Front Cover Spread

- Opposite TOC

Custom Sponsorships

- Onserts

- Inserts

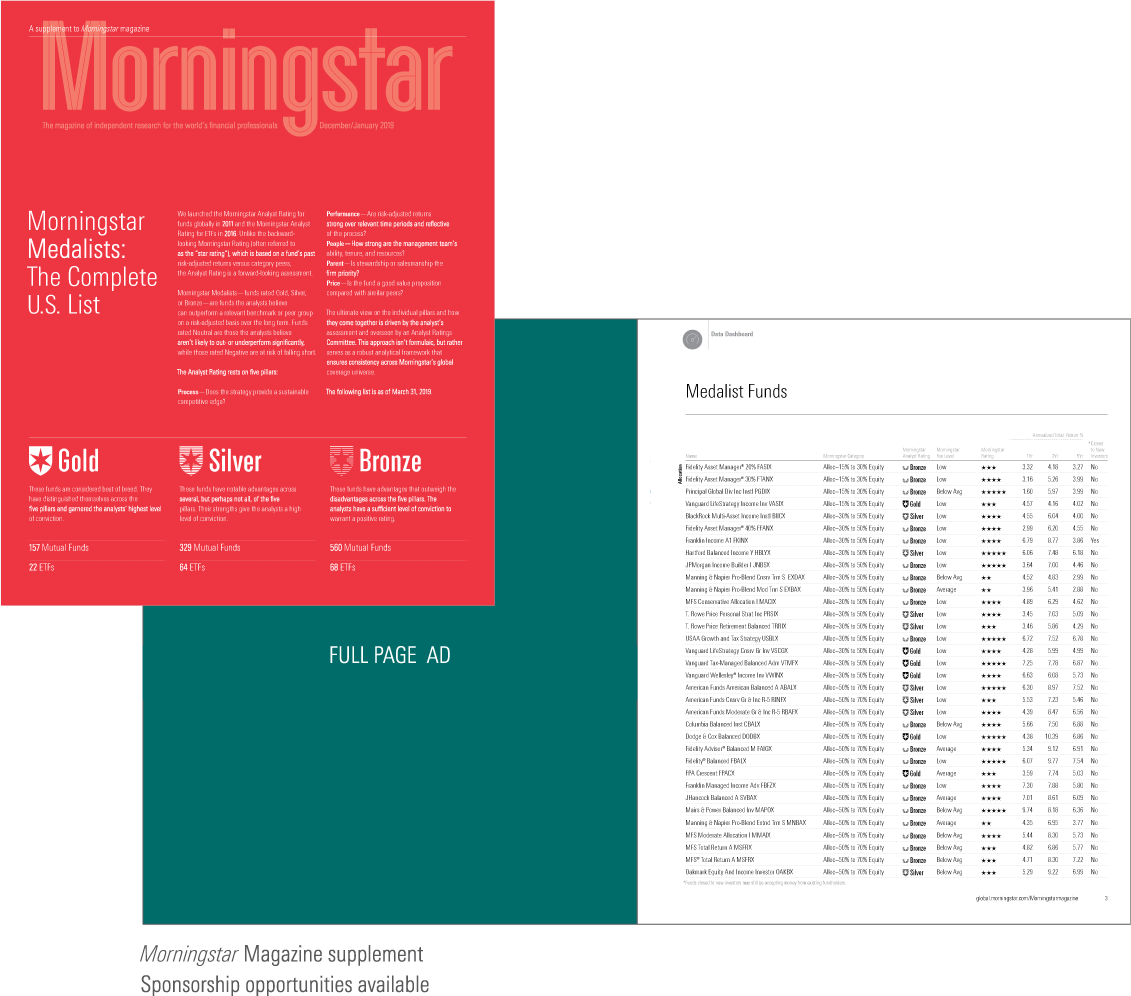

- Morningstar Fund Medalist Supp

*For insertion rates please contact your sales director

Source: Morningstar Advisor Survey 2020.

Ad Specs

Morningstar Magazine 2023 Editorial Calendar

Spotlight topics are subject to change based on availability of research.

Q1 2023

Ad close: December 2, 2022

Materials Due: December 9, 2022

Mail Date: February 10, 2023

Q2 2023

MICUS Issue

Ad Close: March 3, 2023

Materials Due: March 24, 2023

Mail date: May 5, 2023

Q3 2023

Ad Close: June 2, 2023

Materials Due: June 23, 2023

Mail date: August 4, 2023

Q4 2023

Ad Close: September 1, 2023

Materials Due: September 22, 2023

Mail date: November 6, 2023

Thematic Funds' Siren Song

The market for thematic funds has expanded rapidly in recent years. These funds attempt to harness secular growth themes ranging from demographic shifts to the rise of the metaverse. Some have delivered bursts of eye-catching performance, while others have failed to gain traction. As assets have poured into these funds, asset managers around the globe have ramped up the supply of these niche and often gimmicky funds. In this issue, we explore the key characteristics of this often overhyped but poorly understood segment of the fund universe.

Can Fixed Income Bounce Back?

After a brutal year in 2022, bonds have become the asset class everyone loves to hate. Surging interest rates squashed fixed-income returns across all categories. But investors shouldn't give up on bonds altogether. In this issue, we look at the damage that was done to portfolios and look ahead to see if bonds can rebound and return to their diversification role.

Diversification Pays Off

Until recently, the classic 60/40 portfolio combining U.S. stocks and investment-grade bonds was tough to beat. Domestic stocks racked up double-digit annual returns on a regular basis, and bonds provided both strong performance and compelling diversification benefits. But the tables have turned. In 2022, both stocks and bonds suffered double-digit losses. However, this doesn’t mean investors should give up on the concept of diversification. To the contrary. In this issue, we discuss how amid the market’s recent turbulence, broader portfolio diversification strategies have finally started to prove their mettle, underscoring the importance of diversification as a long-term portfolio strategy.

State of Retirement

Life expectancies, the performance of the stock market, changing attitudes about retirement, and skyrocketing interest rates have conspired to make retirement income a constant source of uncertainty in designing drawdown strategies for clients. In this issue, we bring together experts from within and beyond Morningstar to discuss the latest retirement-income research.