Everything You Need to Know About the Enhanced Morningstar Uncertainty Rating

The what, how, and why of our recent change to the rating methodology.

Morningstar launched an updated Uncertainty Rating methodology for stocks that went into effect Sept. 29.

Nothing about the fundamental meaning of our Uncertainty Rating has changed. In fact, we imagine most readers would never have noticed that a change in the background had occurred.

How Did the Rating Change?

We simply added a quantitative tool to our rating process. This quantitative tool uses trailing 12-month standard deviation data to provide an initial suggested rating, which serves as another tool in our analysts’ toolkit. Analysts now start with this suggested rating and then use all the same fundamental analysis they did previously when assigning Uncertainty Ratings as they arrive at a final rating decision.

Our analysts still make the final Uncertainty Rating decision for every stock they cover. They still use the same fundamental intuitions and analysis to assign Uncertainty Ratings. The new rating recommendation tool simply provides a baseline from which the fundamental analysis begins.

Why Did We Implement This Update?

This approach enables us to combine the strengths of an automated, quantitative tool with the advantages of human judgment. We believe that by doing so, our analysts will be more empowered when making their rating decisions and better able to help investors reach their own conclusions.

By starting with a quantitative baseline, greater consistency across analysts, geographies, and sectors should be possible. This ensures that a given Uncertainty Rating means the same thing across all domains for Morningstar’s equity research clients. In other words, a High Uncertainty Rating for an energy company in South America means the same thing as a High Uncertainty Rating for a technology company in South Asia.

Importantly, the meaning of our Uncertainty Rating—both the intuition about what it means and the technical mathematical relationship between our Uncertainty Rating and the Morningstar Fair Value Estimate when producing the Morningstar Rating for stocks—has remained exactly the same.

How Many Ratings Does the Change Affect?

We’ve gone through our entire stock coverage universe and compiled the key data to show how many ratings have changed as a result of the new process and what it means for investors.

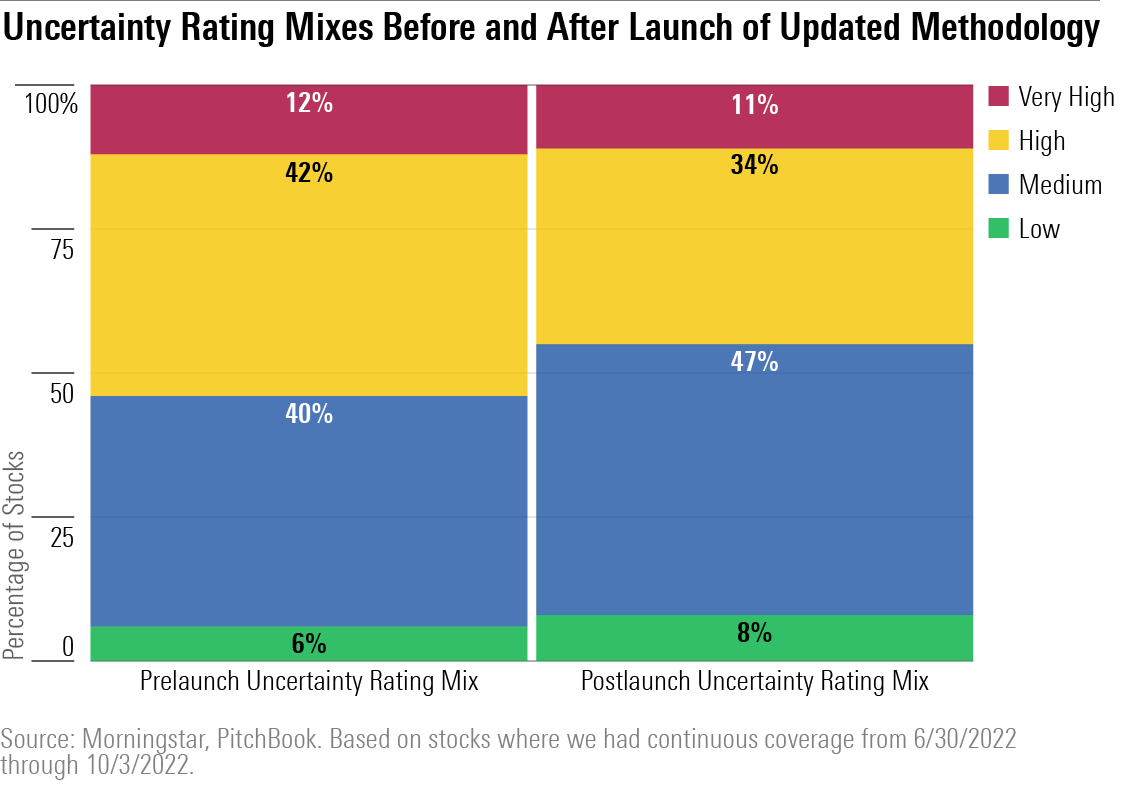

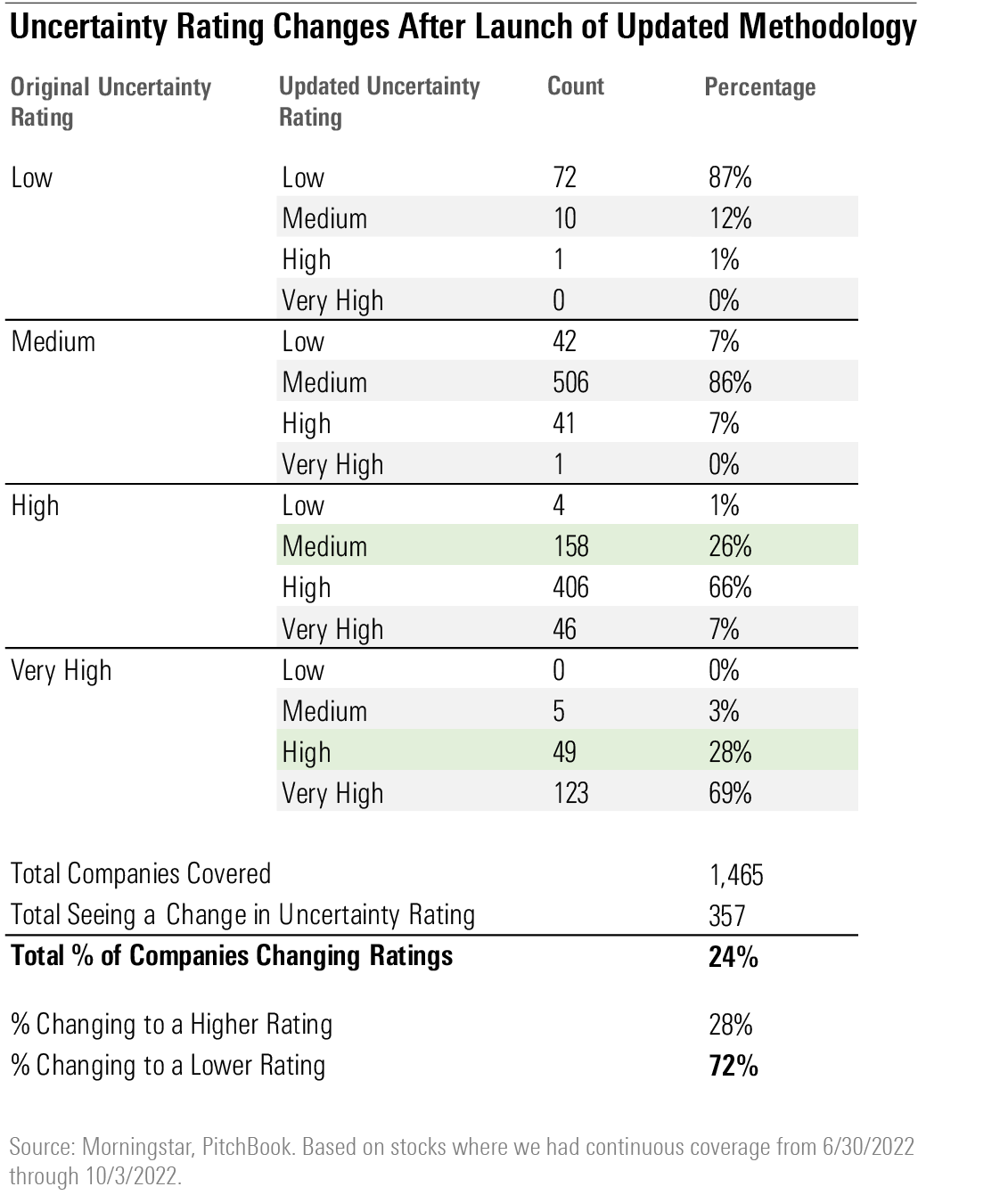

Roughly one fourth—24%, to be exact—of the applicable coverage universe experienced an Uncertainty Rating change during the launch of our new Uncertainty Rating process.

Of the 357 companies that saw a change in Uncertainty Rating, roughly three fourths (72%) saw a decrease in the level of their Uncertainty Rating—that is, a narrowing of the required margin of safety for a given star rating. Roughly one fourth (28%) saw an increase in the level of their Uncertainty Rating, or a widening of the margin of safety. The most common rating change was from High to Medium; a change from Very High to High was the second most common update.

This change should not be interpreted as a view that economic or market uncertainty has recently decreased. Rather, it is simply an update to our process, with our new tool showing that mathematically (based on return distributions), there likely should be more Uncertainty Ratings that were lower than their past ratings. Analysts have agreed with this new nudge often enough to change the distribution of ratings by a moderate degree.

What Effect Will This Have on Star Ratings?

Perhaps one of the most critical questions for investors is the effect of this update on our star ratings.

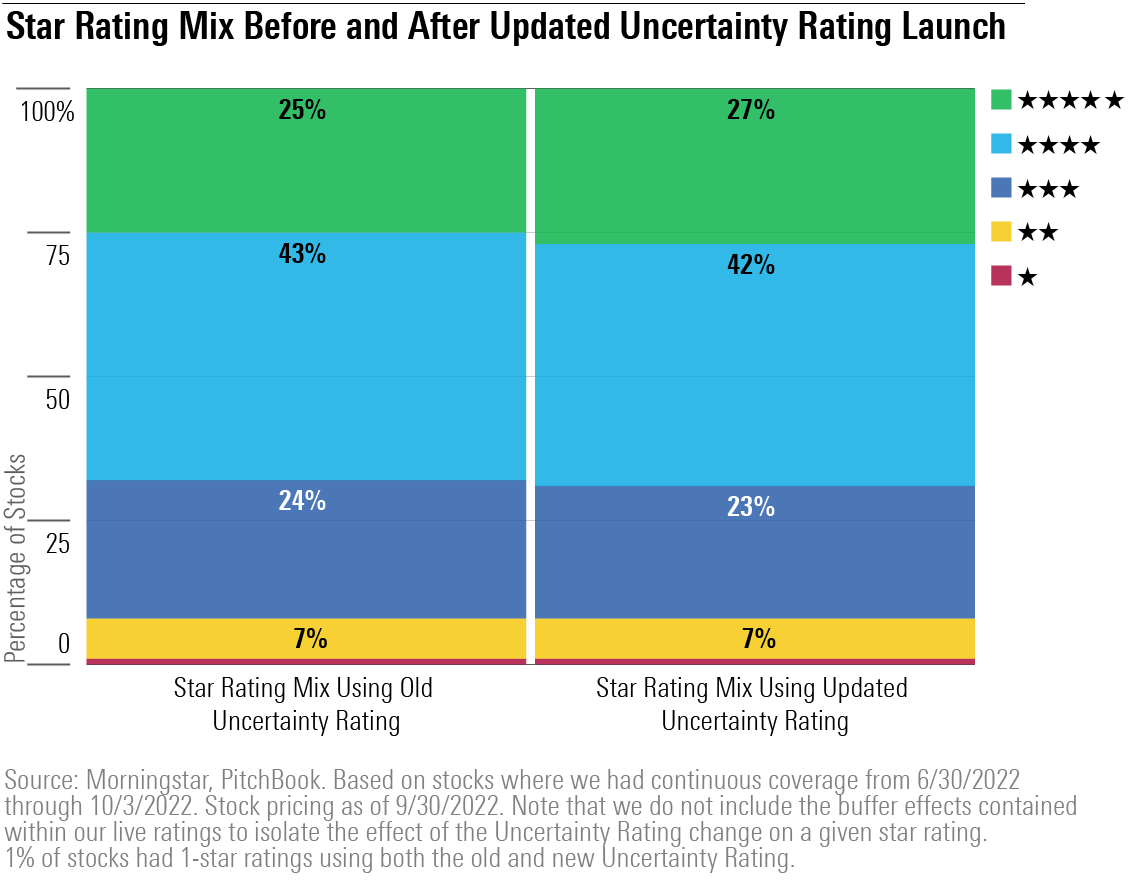

Overall, the effect was fairly small. We think the best way to think of the change is as magnifying our overvalued or undervalued “calls” a bit more, on average. As an Uncertainty Rating changes to a lower level, the margin of safety demanded for a given star rating is also lowered.

Since a larger number of companies saw a decrease in Uncertainty Rating, stocks that may have previously been 3 stars are now more likely to fall into the 4-star or 2-star category, previous 4-star stocks are now more likely to fall into the 5-star category, and 2-star stocks are more likely to fall into the 1-star category. For a refresher on how Uncertainty Ratings interact with our star ratings, see our primer.

It is important to remember that this new process had no effect on our fair value estimates. The price/fair value ratio for each company has not changed as a result of this update.

To summarize, our average Uncertainty Rating is now slightly lower than it was before we launched our updated process. For this reason, we would expect slightly more stocks to be considered overvalued or undervalued.

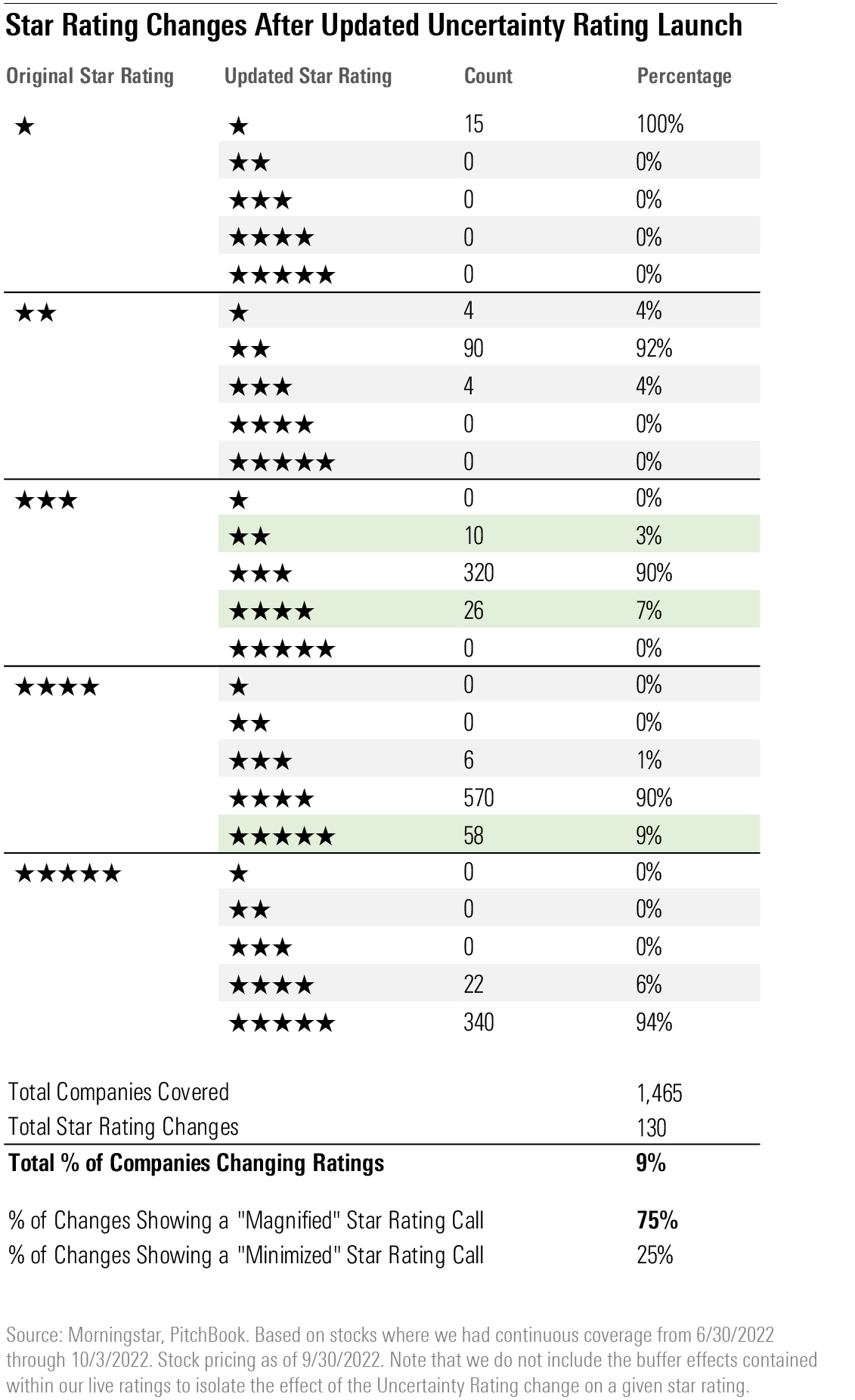

Only 9% of the applicable coverage universe saw a change in star rating driven by the change in Uncertainty Rating, based on stock prices as of the Sept. 30 close. With so few ratings changing, the overall mix of our star ratings did not change much. The most common change was for an undervalued 4-star stock to have its call amplified by a decline in the Uncertainty Rating, bumping it up to a 5-star rating. As a result, the percentage of 5-star calls edged up, while the percentage of 4-star calls edged down.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MG6XOCYGF5BO7MG5YRNBISB3SA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TXAOQ3NTDNAVLGMP3O4BVUVFTA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RH6K4NMACRHO3DQIPX57HVLLAU.png)